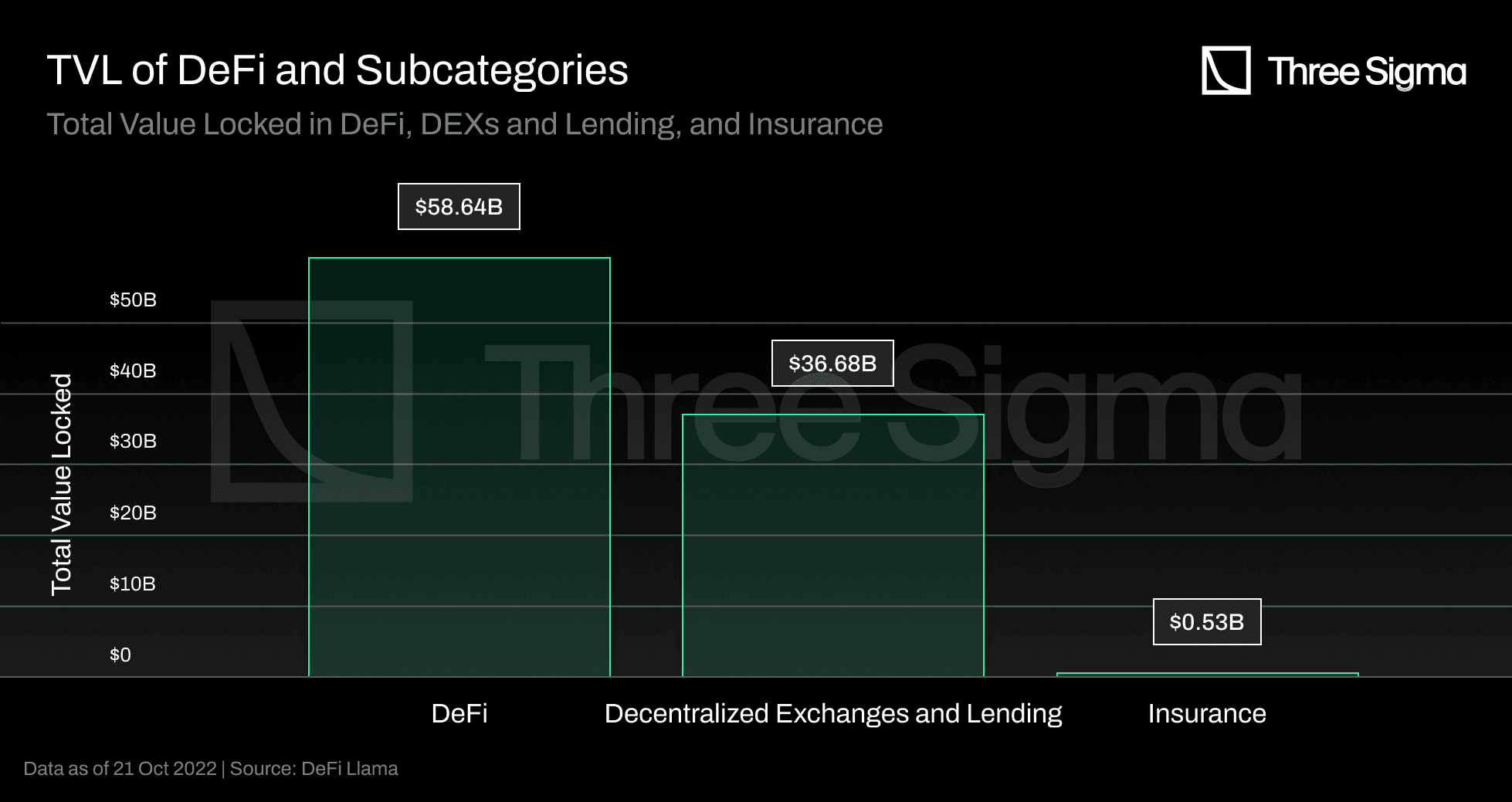

Stablecoins have become the backbone of DAO treasuries, offering a programmable, liquid, and relatively stable asset for decentralized organizations to manage operational funds, pay contributors, and hedge against the notorious swings of the crypto market. Yet, as the industry has learned through events like the USDC and UST depegs, stablecoins are not risk-free. For DAOs managing multi-million dollar treasuries, a single depeg event can jeopardize months or years of runway. This is where stablecoin hedge vaults enter the picture, delivering automated, on-chain protection against both depegging and broader market volatility.

Why Stablecoin Volatility Demands Advanced DAO Treasury Risk Management

Stablecoins are engineered to maintain a 1: 1 peg to reference assets like the US dollar or euro, typically through collateralization or algorithmic mechanisms. Their promise: to bridge the gap between volatile cryptocurrencies and the stability required for real-world commerce and DAO operations. According to Tazapay, stablecoins enhance liquidity with fast, low-cost transfers and act as a hedge against currency volatility. However, as highlighted by the CFA Institute, the connection between stablecoins and traditional assets like Treasury bills can create feedback loops that impact both DeFi and legacy markets. Inflows and outflows from stablecoins can move short-term yields, and poorly managed stablecoins can transmit shocks or heighten volatility, as noted by TD Economics.

For DAOs, this means that simply holding stablecoins is not enough. Proactive DAO treasury risk management now requires tools that can dynamically respond to market stressors, automate risk mitigation, and ensure operational continuity even in the face of unexpected depegs.

How Stablecoin Hedge Vaults Provide On-Chain Protection

Stablecoin hedge vaults are purpose-built DeFi instruments that automate the process of hedging against depegs and market swings. These vaults use a combination of automated hedging modules, on-chain derivatives, and depeg insurance protocols to deliver robust, real-time protection for DAO treasuries.

- Automated Hedging Modules: Protocols like Angle Protocol enable DAOs to deposit stablecoins into smart contract vaults that dynamically manage exposure using perpetual swaps or options. When a stablecoin’s price slips below its peg, the vault can trigger hedges or rebalance into more stable assets, minimizing losses. For an in-depth look at how these work in practice, visit depegwatch.com.

- On-Chain Depeg Insurance: Insurance protocols monitor stablecoin price feeds and automatically execute payouts if a depeg event exceeds a predefined threshold. These smart contracts remove manual claims processing and offer transparent, rapid compensation. Explore the mechanics at depegwatch.com.

The programmability and composability of these automated stablecoin vaults make them a foundational tool for on-chain stablecoin protection. They allow DAOs to implement privacy-preserving DeFi vaults that operate 24/7, adapting to market signals in real time.

Key Features of Leading Stablecoin Hedge Vault Protocols

-

Automated Hedging Modules (e.g., Angle Protocol): Leverage real-time DeFi derivatives like perpetual swaps and options to dynamically manage stablecoin exposure, minimizing losses from depegging events and market swings.

-

On-Chain Depeg Insurance (e.g., InsurAce, Nexus Mutual): Employ smart contracts that monitor stablecoin price feeds and trigger instant payouts when depegs occur, providing transparent and rapid compensation for DAO treasuries.

-

Diversified Stablecoin Holdings: Allocate treasury assets across multiple stablecoins (such as USDC, USDT, and DAI) to reduce reliance on any single issuer and mitigate the impact of isolated depegging incidents.

-

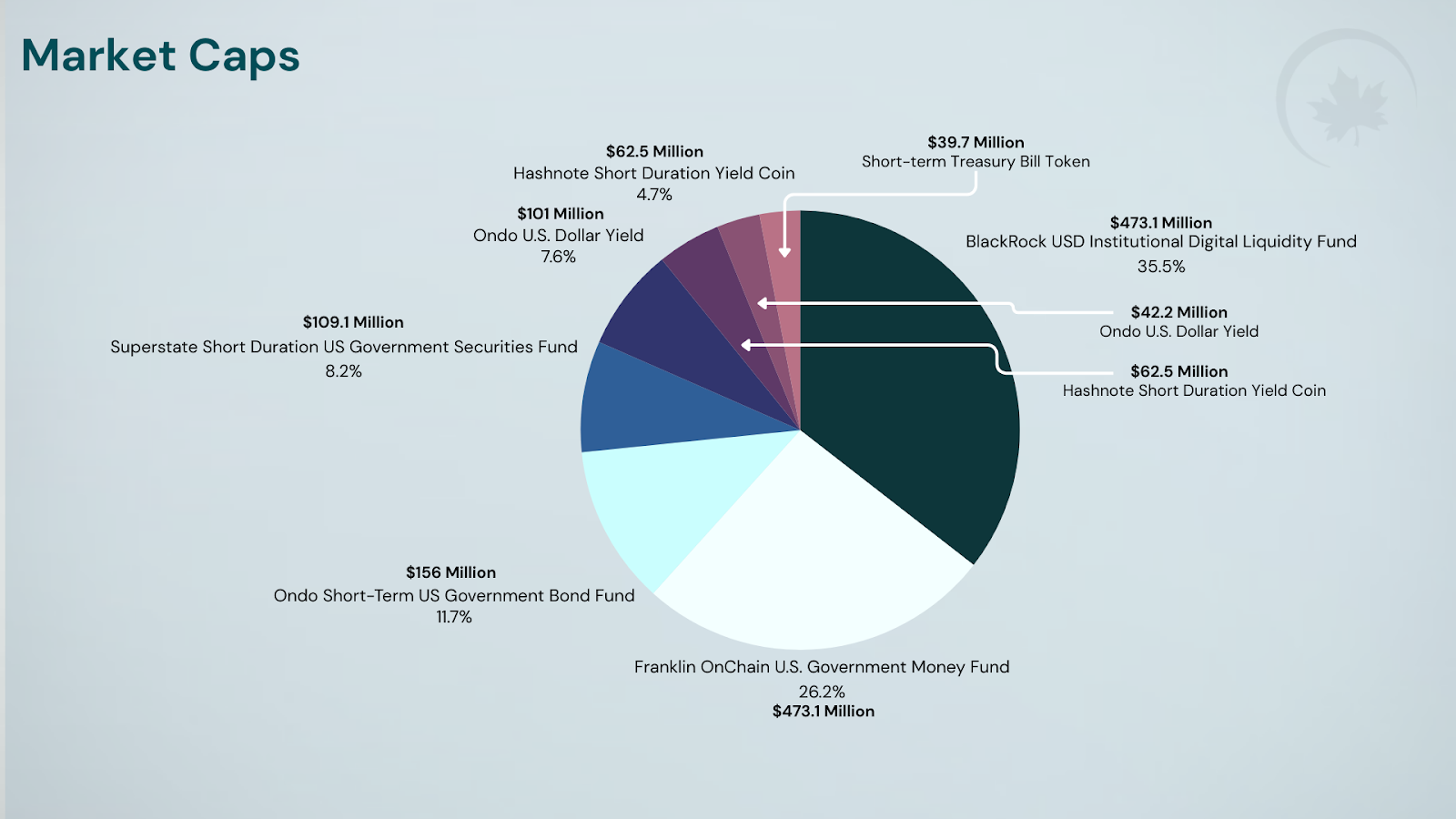

Inclusion of Tokenized Real-World Assets (e.g., Ondo Finance, Matrixdock): Integrate tokenized U.S. Treasuries and bonds into vaults, providing additional stability through low-correlation, yield-generating traditional assets.

-

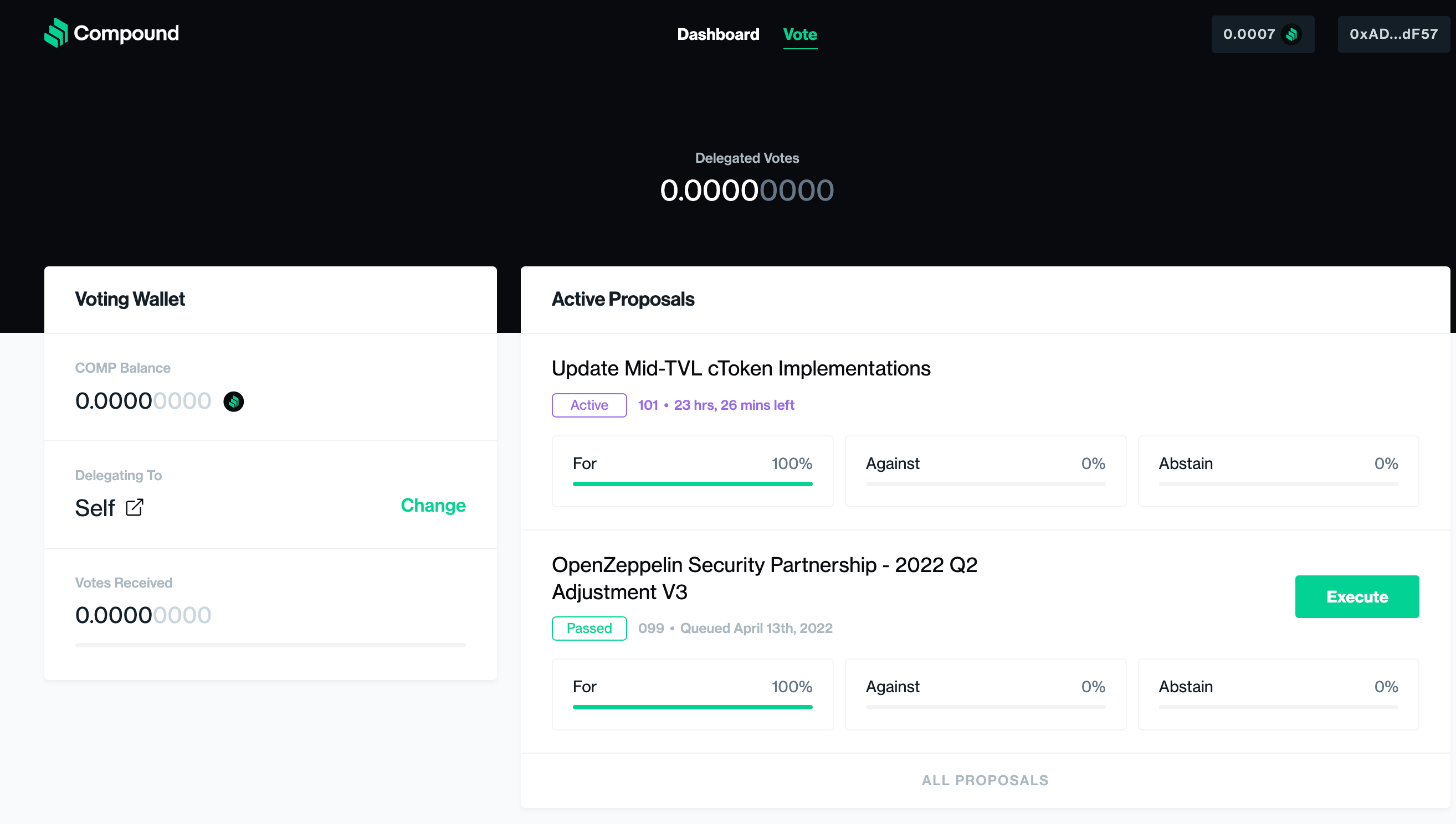

Yield-Generating Vault Strategies (e.g., Aera Vaults by Compound DAO): Reinvest non-native assets into lending protocols and yield strategies to grow DAO treasuries while managing risk from market volatility and stablecoin depegs.

-

Transparent Governance and Risk Monitoring: Utilize on-chain governance frameworks and real-time risk dashboards to empower DAOs with oversight and rapid decision-making during periods of volatility or depegging threats.

Diversification: The First Layer of Depeg Protection for DAOs

No risk management strategy is complete without diversification. Relying on a single stablecoin exposes DAOs to the idiosyncratic risks of that asset – from smart contract bugs to regulatory shocks. The most resilient DAOs now allocate treasury assets across multiple stablecoins such as USDC, USDT, DAI, and others. This approach spreads risk and ensures that the failure or depegging of one does not cripple the entire treasury.

Some organizations go further by incorporating tokenized real-world assets like U. S. Treasuries or bonds into their portfolios. These assets are less correlated with crypto market cycles and offer an additional buffer against volatility. For more on how DAOs are structuring these diversified treasuries, see blockchainappfactory.com.

Real-World Examples: NFTX DAO and Compound DAO Adaptation

The lessons from recent depegging incidents have prompted DAOs like NFTX and Compound to overhaul their treasury strategies. After the USDC depeg saga, NFTX DAO rebalanced $2 million in its treasury to secure operational longevity by diversifying into multiple assets (daotimes.com). Meanwhile, Compound leverages Aera Vaults to reinvest non-native assets within its own lending markets – a move designed both for yield generation and enhanced risk management (medium.com).

These real-world adaptations underscore a critical evolution: DAO treasuries are no longer passive pools of stablecoins. Instead, they are becoming actively managed, risk-aware capital reserves that blend on-chain automation with diversified asset strategies. The result is a treasury that can withstand depeg shocks and continue to fund DAO operations, contributor payments, and protocol growth even in turbulent markets.

Automated Stablecoin Vaults: The New Standard for On-Chain Treasury Security

What sets modern automated stablecoin vaults apart is their ability to operate with minimal human intervention. By leveraging smart contracts and price oracles, these systems can detect early signs of depegging or liquidity stress and execute hedges or insurance claims within seconds. This speed is essential when minutes can mean millions lost during market dislocations.

The best hedge vault protocols also offer granular stablecoin collateral tracking, transparent audit trails, and privacy-preserving features that protect sensitive treasury data while maintaining accountability. For DAOs with global contributors and complex governance structures, this level of automation is not just a convenience – it’s a necessity for scaling securely.

Key Steps for DAOs to Deploy Stablecoin Hedge Vaults

-

Assess Treasury Exposure and Risk Tolerance: Begin with a comprehensive audit of your DAO’s treasury, identifying current stablecoin allocations and evaluating exposure to depegging and market volatility. Establish clear risk parameters to guide hedging strategies.

-

Select a Reputable Automated Hedge Vault Protocol: Integrate with established DeFi protocols such as Angle Protocol, which offers automated hedging modules. These vaults dynamically manage stablecoin exposure using derivatives like perpetual swaps or options to protect against depegs.

-

Implement On-Chain Depeg Insurance Solutions: Add coverage through on-chain depeg insurance protocols that use smart contracts to monitor stablecoin price feeds and trigger payouts upon depeg events. This ensures rapid, transparent compensation for treasury losses.

-

Diversify Stablecoin Holdings Across Multiple Assets: Reduce single-asset risk by allocating treasury funds among several major stablecoins such as USDC, USDT, and DAI. This diversification helps mitigate the impact of a single stablecoin’s failure.

-

Incorporate Tokenized Traditional Assets: Enhance stability by including tokenized real-world assets like U.S. Treasuries or bonds. These assets are less correlated with crypto markets and provide a buffer against digital asset volatility.

-

Establish Automated Monitoring and Governance Processes: Set up real-time monitoring tools and clear governance frameworks to oversee hedge vault performance, trigger rebalancing, and respond swiftly to market events.

-

Review and Optimize Treasury Strategy Regularly: Analyze outcomes and adjust strategies based on performance data and evolving market conditions. Learn from real-world cases such as NFTX DAO and Compound DAO to continually strengthen treasury resilience.

Building Resilience: Best Practices for DAO Treasury Risk Management

To maximize the effectiveness of on-chain stablecoin protection, DAOs should adopt a layered approach:

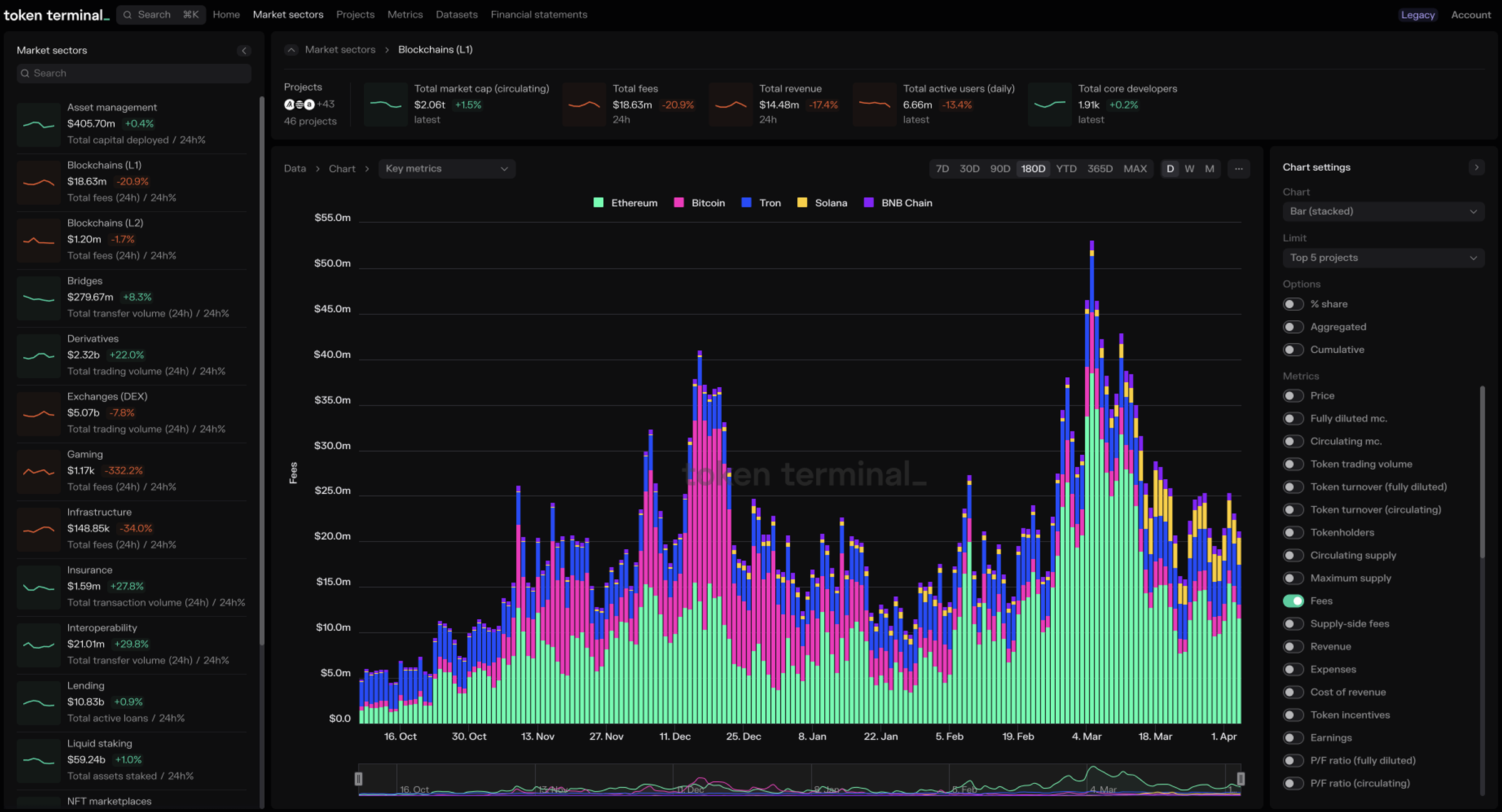

- Continuous Monitoring: Use real-time analytics and dashboards to track stablecoin health, vault performance, and market signals.

- Diversification: Maintain exposure across multiple stablecoins and add tokenized real-world assets where feasible.

- Automated Hedging and Insurance: Integrate hedge vaults that offer both dynamic hedging modules and on-chain depeg insurance.

- Governance Automation: Automate treasury rebalancing proposals based on preset risk thresholds to ensure timely responses without governance bottlenecks.

- Transparent Reporting: Publish regular risk reports to keep community stakeholders informed and engaged.

The next generation of DAOs will be defined by their ability to automate smart – but safeguard smarter. Stablecoin hedge vaults are at the core of this transition from reactive treasury management to proactive resilience engineering.

Future Outlook: On-Chain Treasuries Empowered by Automation

The trajectory is clear: as DeFi matures, DAO treasuries will increasingly rely on automated systems for both growth and protection. Protocol innovation in areas like privacy-preserving DeFi vaults, cross-chain collateralization, and programmable insurance will further empower decentralized organizations to withstand shocks without compromising transparency or operational agility.

The key takeaway? No single tool or asset guarantees safety. But by combining diversified holdings with automated hedge vault strategies – all governed transparently on-chain – DAOs can transform volatility from an existential threat into a manageable variable. This shift not only secures the present but also lays the groundwork for scalable treasury operations as DAOs continue their ascent in the digital economy.