Autonomous treasury protocols have become the linchpin of DAO capital efficiency in 2025, reimagining the way decentralized organizations manage and compound assets. Gone are the days of manual rebalancing, slow governance cycles, and human error draining protocol yields. Today’s most advanced DAOs are leveraging AI-driven agents and algorithmic frameworks to ensure that every idle dollar is put to work – securely, transparently, and at machine speed.

From Human Bottlenecks to Autonomous Agents: The Rise of Talos

Among the pioneers leading this transformation is Talos, the first fully autonomous treasury protocol deployed on Arbitrum. Talos exemplifies how AI-managed treasuries can eliminate execution bottlenecks, ensuring capital is always compounding and resilient against market shocks. By allocating funds to low-risk, fully auditable on-chain strategies – with outcomes independently verifiable – Talos has set a new standard for transparency and trust in DeFi treasury management.

This approach has already delivered compelling results. According to Phemex, Talos manages $2.8M with a 22.9% annualized return, all while maintaining robust risk controls. The protocol’s agentic design allows it not only to optimize yield strategies but also propose protocol upgrades autonomously, ushering in a new era where AI acts as both capital allocator and protocol steward.

Modular Automation: The Decentralised Multi-Manager Fund Framework

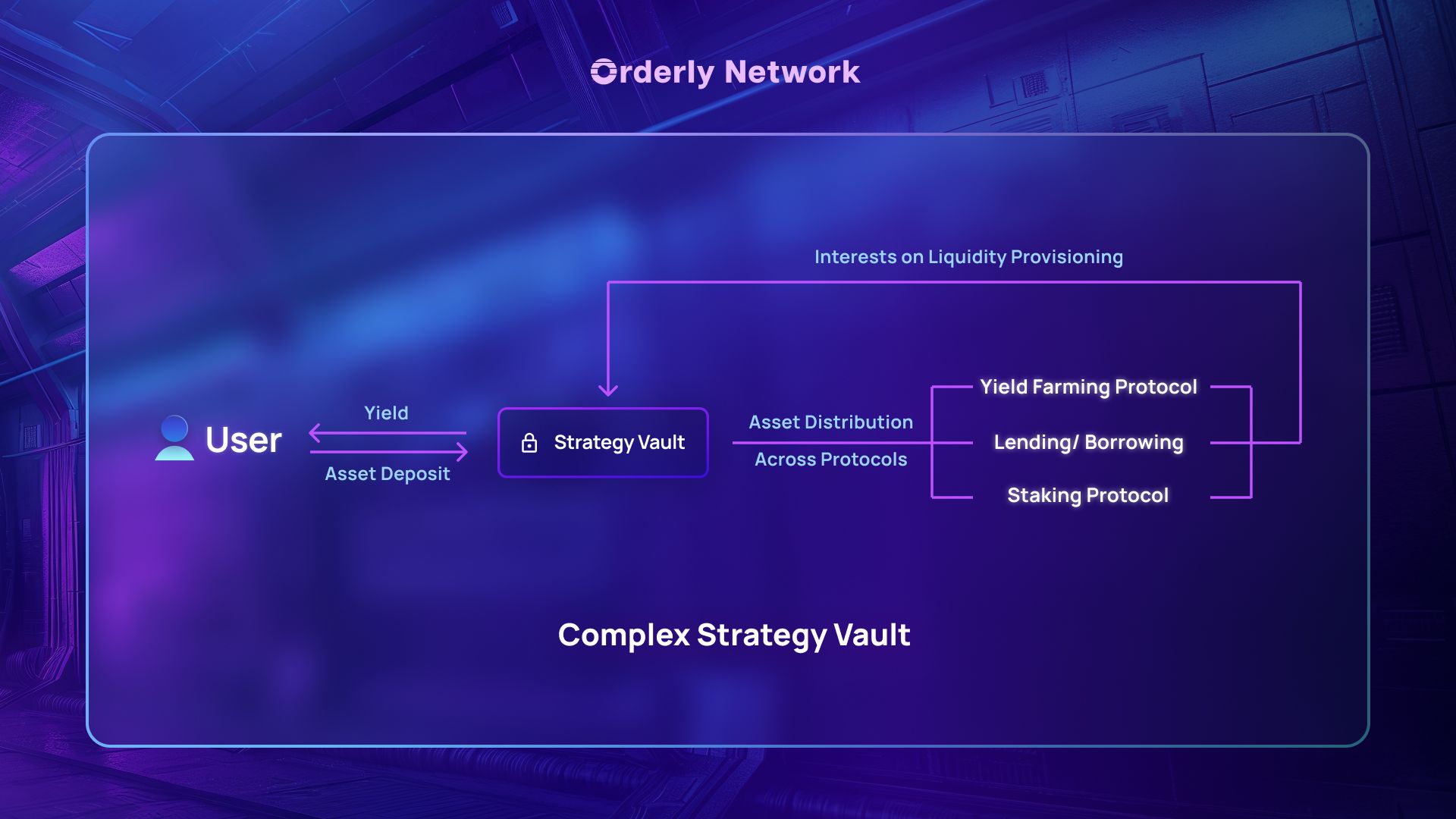

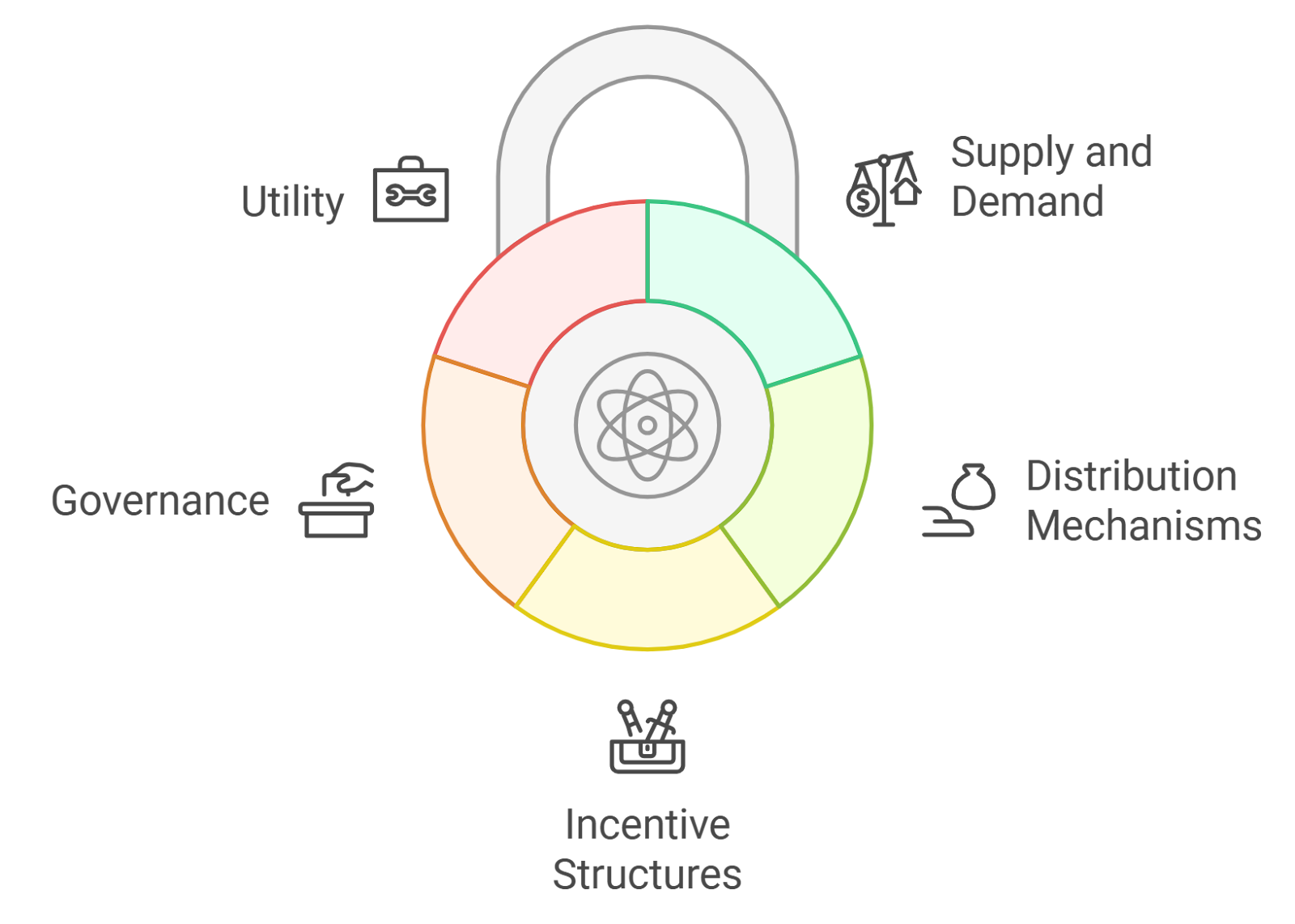

What sets autonomous treasury protocols apart is their modular architecture. The Decentralised Multi-Manager Fund Framework introduces a permissionless system where capital allocation is distributed across tokenized vaults managed by both human strategists and autonomous agents. This framework consists of four distinct layers:

Key Features of the Decentralised Multi-Manager Fund Framework

-

Algorithmic, Multi-Strategy Asset Management: The framework enables permissionless, on-chain capital allocation via tokenized vaults, mirroring a multi-strategy asset manager. Its modular architecture—comprising capitalization, strategy, execution, and validated allocation layers—lets DAOs efficiently diversify and optimize treasury deployment without centralized oversight.

-

Automated, AI-Driven Treasury Optimization: Leveraging advanced machine learning, the framework supports AI agents that analyze historical and real-time data to automate rebalancing, risk assessment, and predictive yield farming. Recent tools have increased average DAO yields by 32% over manual strategies, with predictive models achieving 72% accuracy in yield optimization.

-

Dynamic, Learning-Based Governance: Integrated with frameworks like Auto.gov, the system employs deep reinforcement learning to automate key governance parameters. This reduces human bias, enhances protocol profitability (outperforming static models by tenfold in tests), and improves security by proactively mitigating risks such as price oracle attacks.

-

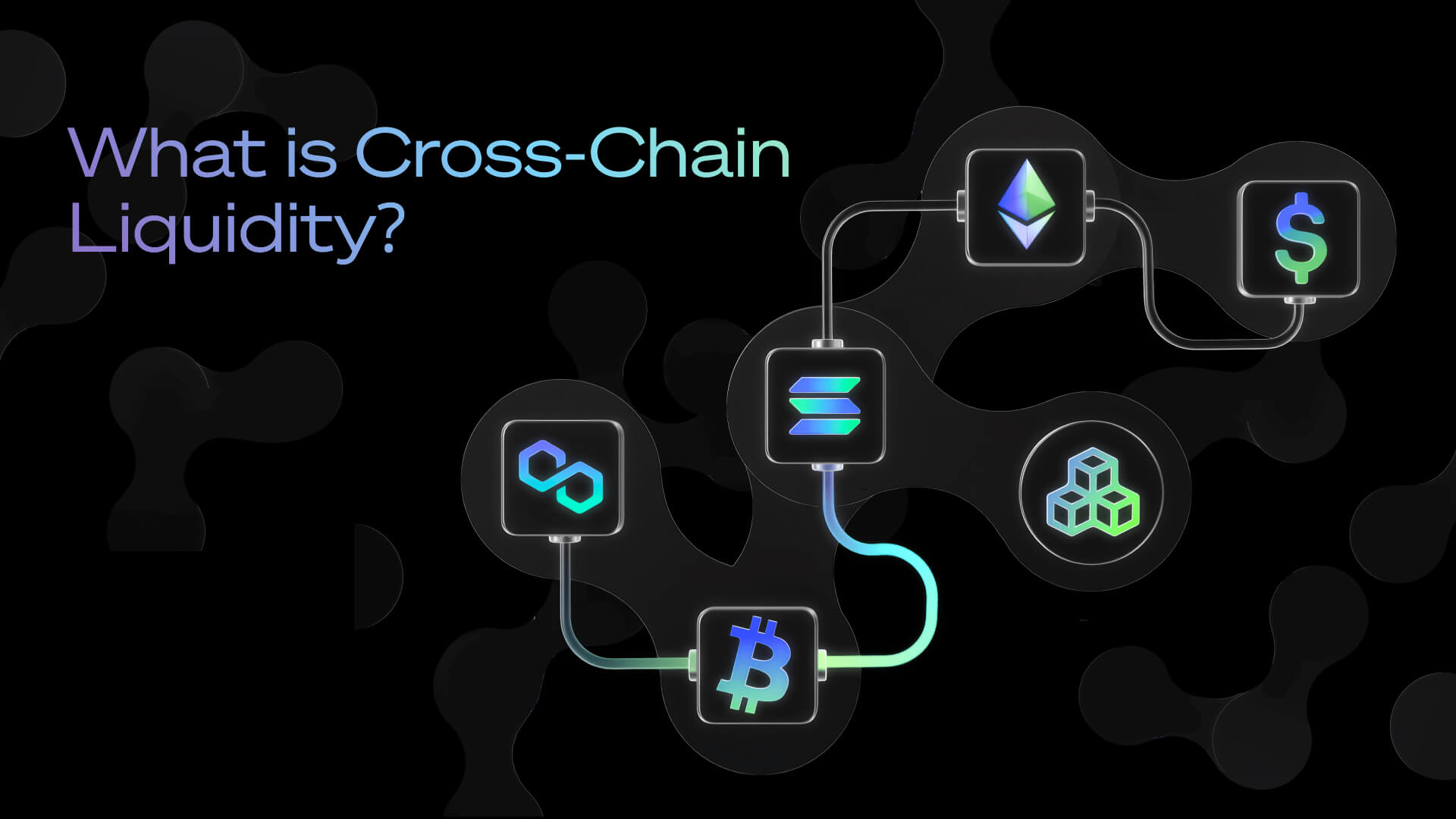

Cross-Chain Interoperability: The framework facilitates seamless treasury operations across major blockchains—including Ethereum, Bitcoin DeFi, and Layer 2s—enabling DAOs to simultaneously capture yield opportunities in multiple ecosystems. Automated bridges and atomic swaps ensure instant, secure asset transfers and strategy execution across networks.

-

Transparent, Auditable On-Chain Operations: Every strategy, allocation, and governance action is recorded on-chain, allowing independent verification and real-time auditing. This transparency builds trust with DAO stakeholders and ensures compliance with evolving DeFi standards.

The result? DAOs gain access to a decentralized marketplace of validated yield strategies while retaining full control over risk limits and asset exposure. Automated rebalancing ensures that capital flows toward strategies delivering superior risk-adjusted returns – all without centralized oversight or manual intervention.

This paradigm shift enables DAOs to adapt quickly to changing market conditions, reduce operational overheads, and maximize on-chain treasury efficiency in ways previously unattainable through traditional governance models. For a deeper dive into how this architecture works in practice, see this technical overview.

AI-Driven Treasury Management: Quantifying the Efficiency Gains

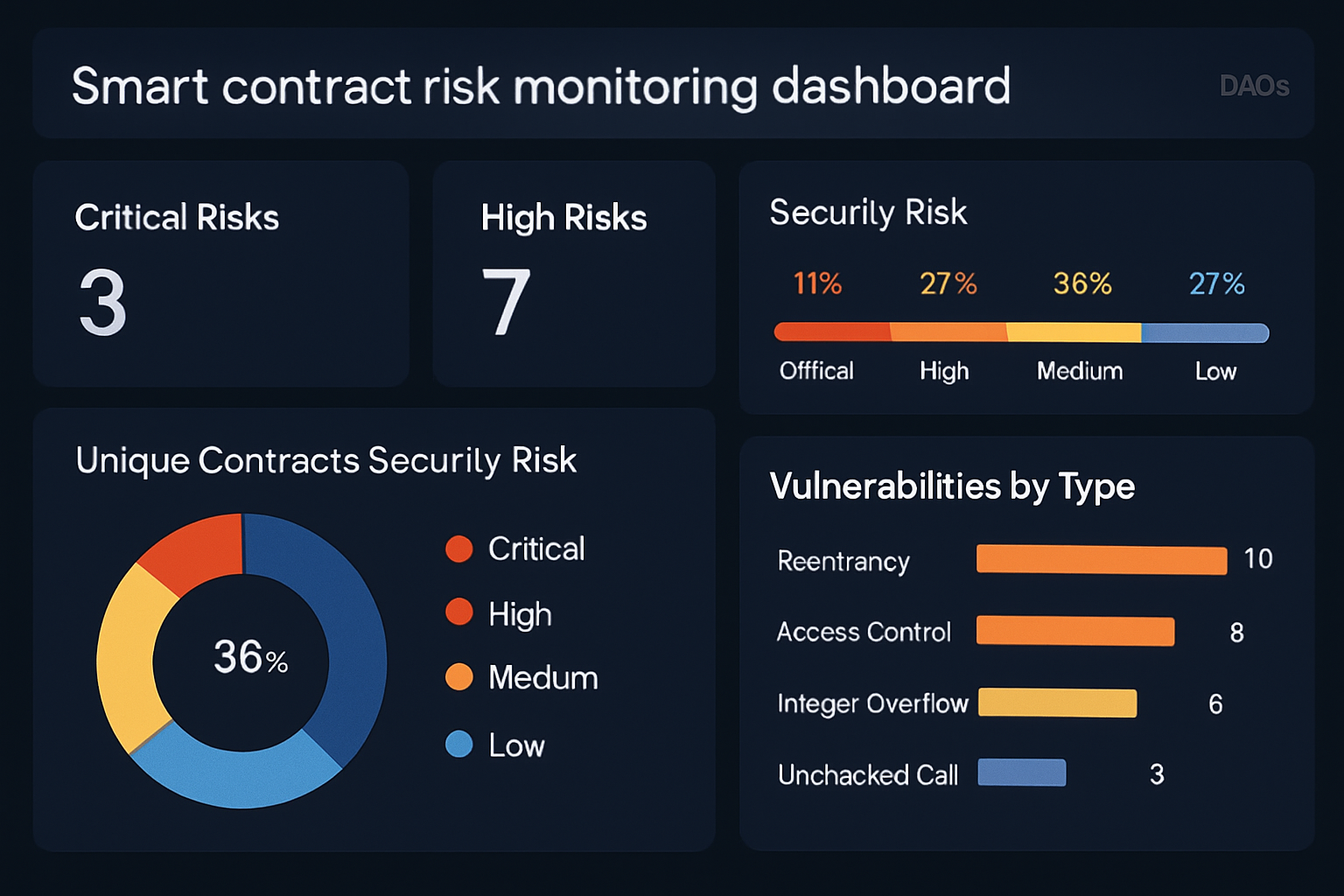

The numbers speak for themselves: DAOs utilizing AI-driven treasury management tools have seen average yields rise by 32% compared to legacy manual approaches (source). These tools harness machine learning models capable of real-time risk assessment across more than 18 blockchain networks, automated rebalancing based on volatility patterns, predictive yield farming with up to 72% accuracy rates, and even smart contract vulnerability detection.

The cumulative effect is profound: inefficiencies that once cost DAOs an estimated 12.4% in lost annual yield are now being systematically eliminated by autonomous protocols that never sleep or tire.

Yet, the impact of autonomous treasury protocols extends beyond yield optimization. By integrating cross-chain interoperability, these systems empower DAOs to nimbly deploy capital across Ethereum, Bitcoin DeFi protocols, and Layer 2 solutions like Arbitrum, without manual bridging or downtime. This agility allows treasuries to capture fleeting yield opportunities wherever they arise, while maintaining robust risk controls and compliance with predefined governance parameters.

Consider a scenario where a DAO simultaneously lends ETH on Ethereum and provides BTC liquidity on another chain. Automated agents can orchestrate these complex strategies in seconds, rebalancing allocations dynamically as market conditions shift. The result is a treasury that is not only more efficient but also more resilient, able to sidestep network congestion, exploit arbitrage windows, and respond instantly to protocol-level threats or opportunities.

Automated Governance: From Reactive to Proactive Risk Management

Another game-changer is the rise of automated governance frameworks such as Auto. gov. By leveraging deep reinforcement learning, these systems continuously adjust protocol parameters in response to real-world data, minimizing human bias and improving both profitability and security. In live deployments modeled after leading lending platforms, Auto. gov retained funds that would have otherwise been lost to price oracle attacks and outperformed static models by an order of magnitude (technical details).

This shift from reactive, proposal-driven governance to proactive, data-driven automation marks a watershed moment for DeFi risk management. Protocols can now fine-tune interest rates, collateral factors, and liquidation thresholds in real time, maximizing returns while safeguarding against systemic shocks.

Key Benefits of Automated DAO Governance for Capital Efficiency

-

Continuous, Algorithmic Asset Management: Autonomous treasury protocols like Talos leverage smart contracts to automate portfolio allocation and rebalancing, ensuring DAO assets are always compounding and responding to market conditions without manual intervention.

-

Data-Driven, Adaptive Governance: Solutions such as Auto.gov use deep reinforcement learning to optimize DeFi protocol parameters in real time, reducing human bias and improving profitability—outperforming static models by up to tenfold in protocol returns.

-

Enhanced Yield Through AI-Driven Treasury Tools: AI-powered platforms analyze historical and real-time data across 18+ blockchains, enabling DAOs to achieve average yield increases of 32% and predictive yield farming accuracy rates of 72%, while minimizing manual inefficiencies.

-

Seamless Cross-Chain Capital Deployment: Automated treasury agents facilitate instant asset transfers and strategy execution across Ethereum, Bitcoin DeFi, and Layer 2 networks, empowering DAOs to capture yield opportunities in multiple ecosystems simultaneously.

-

Reduced Operational Risk and Attack Surface: By automating execution and integrating smart contract vulnerability detection, autonomous protocols help DAOs mitigate risks such as oracle attacks and human error, safeguarding treasury assets.

What’s Next? The Road Ahead for On-Chain Treasury Efficiency

The trajectory is clear: as AI sophistication grows and interoperability standards mature, autonomous treasury protocols will become the default operating system for DAO capital management. Expect further advances in predictive analytics, multi-network composability, and trustless auditing, each reinforcing the flywheel of efficiency gains.

However, this new paradigm also raises fresh questions about transparency, accountability, and the balance between machine autonomy and human oversight. DAOs must invest in robust monitoring tools and clear escalation paths for exceptional events, even as they cede day-to-day control to code-based agents.

For DAO operators seeking an edge in 2025’s competitive DeFi landscape, embracing autonomous treasury protocols is no longer optional, it is essential for survival. The protocols that master this transition will enjoy not only higher yields but also greater resilience against volatility and black swan events.