As DAOs mature and their treasuries swell, the need for automated stablecoin vaults has moved from a nice-to-have to a strategic imperative. Manual asset management exposes decentralized organizations to operational inefficiencies, human error, and missed yield opportunities. In 2025, best-in-class DAOs are leveraging on-chain treasury solutions that combine programmable automation, robust governance, and stablecoin security to optimize capital deployment without sacrificing transparency or control.

Why Automated Stablecoin Vaults Are Now Essential for DAO Treasury Management

The days of idly holding native tokens or scattered assets in multisig wallets are fading fast. Today’s DAOs must pursue capital efficiency while managing risk in volatile crypto markets. Automated stablecoin vaults empower treasuries to:

- Preserve capital by allocating a portion of reserves to dollar-pegged assets like USDT, USDC, or DAI.

- Generate yield through automated strategies such as lending, liquidity provision, or protocol-native incentives.

- Diversify exposure across multiple protocols and blockchains to mitigate systemic risk.

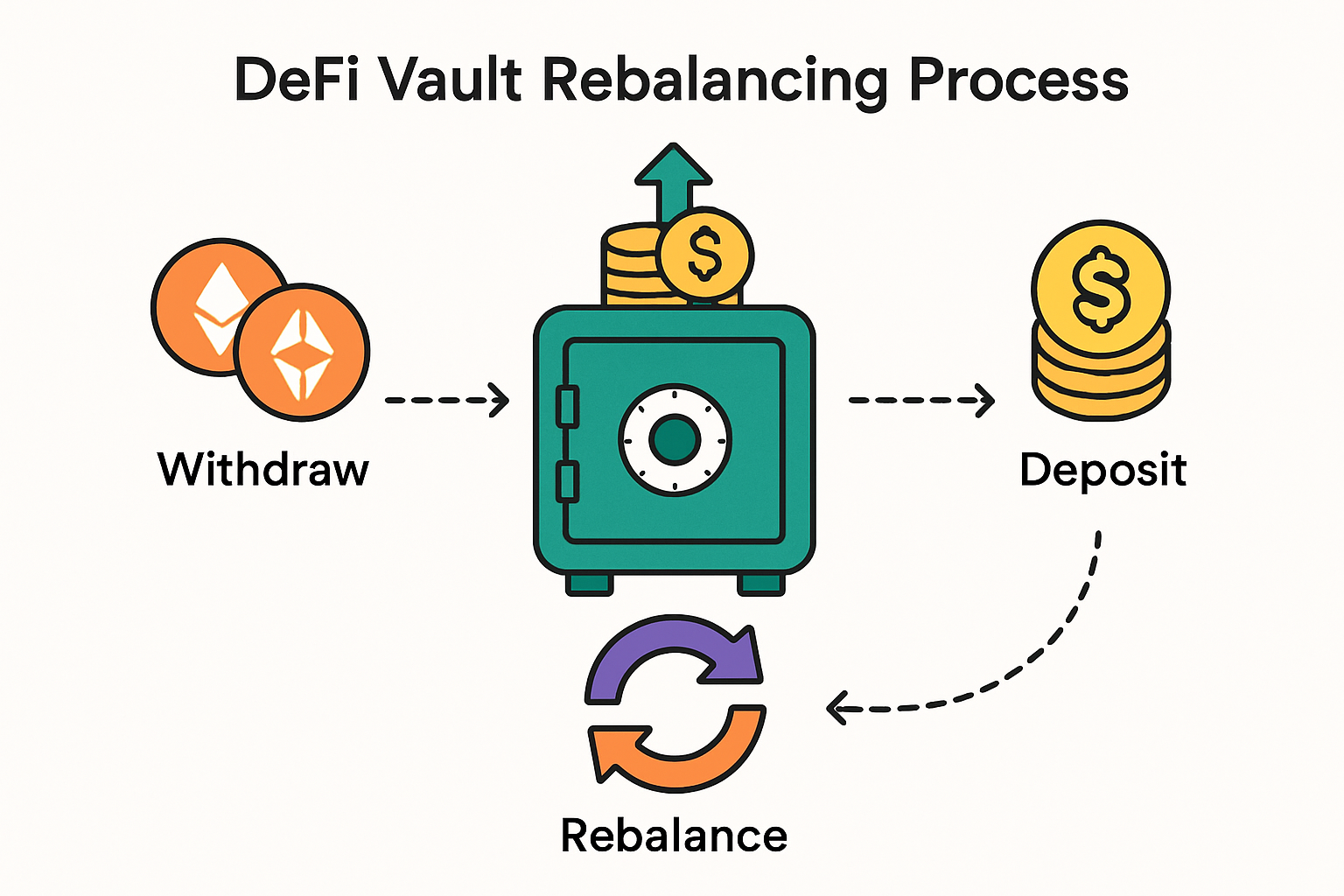

- Automate rebalancing, ensuring allocations remain aligned with evolving risk appetites and market conditions.

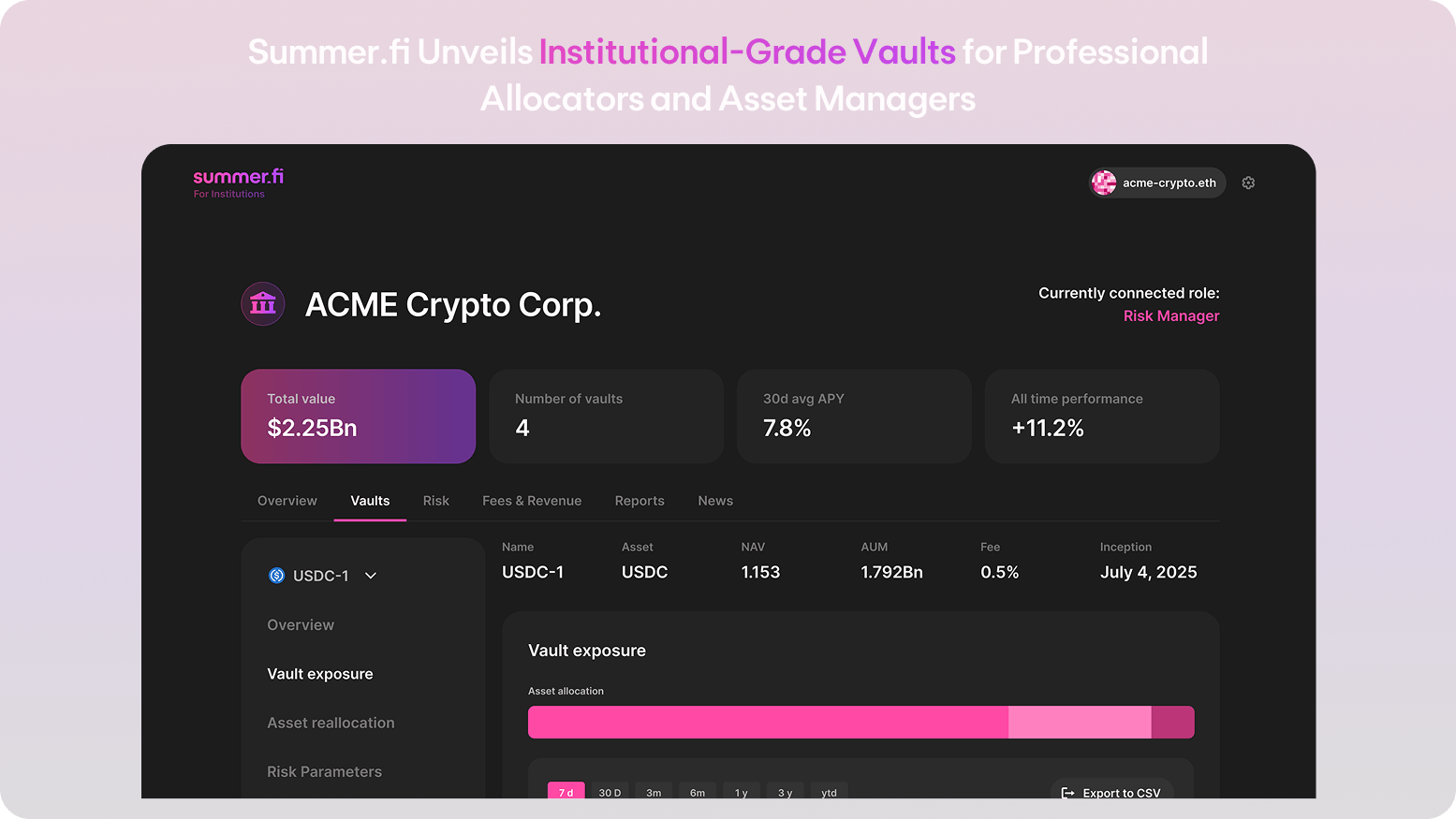

- Centralize oversight, offering real-time analytics and transparent reporting for all stakeholders.

The new standard is clear: automation isn’t just about convenience, it’s about institutional-grade discipline for decentralized treasuries.

– Julian Mercer

A Step-by-Step Approach: Setting Up Your DAO’s Automated Stablecoin Vaults

The process begins with clarity of vision. DAOs must first define their treasury objectives, whether it’s maximizing runway, funding growth initiatives, or hedging against volatility. Once objectives are set, the following steps provide a proven path:

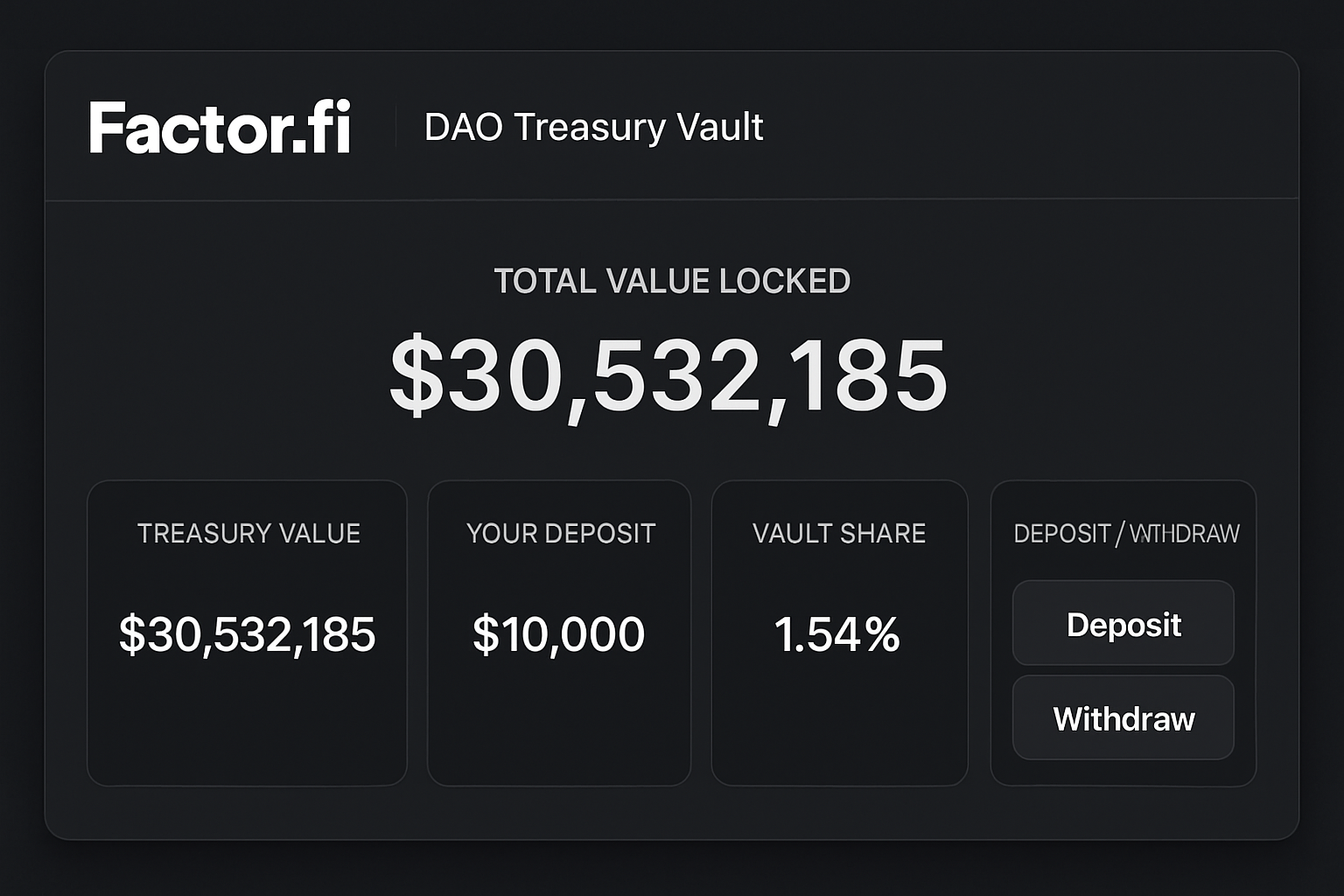

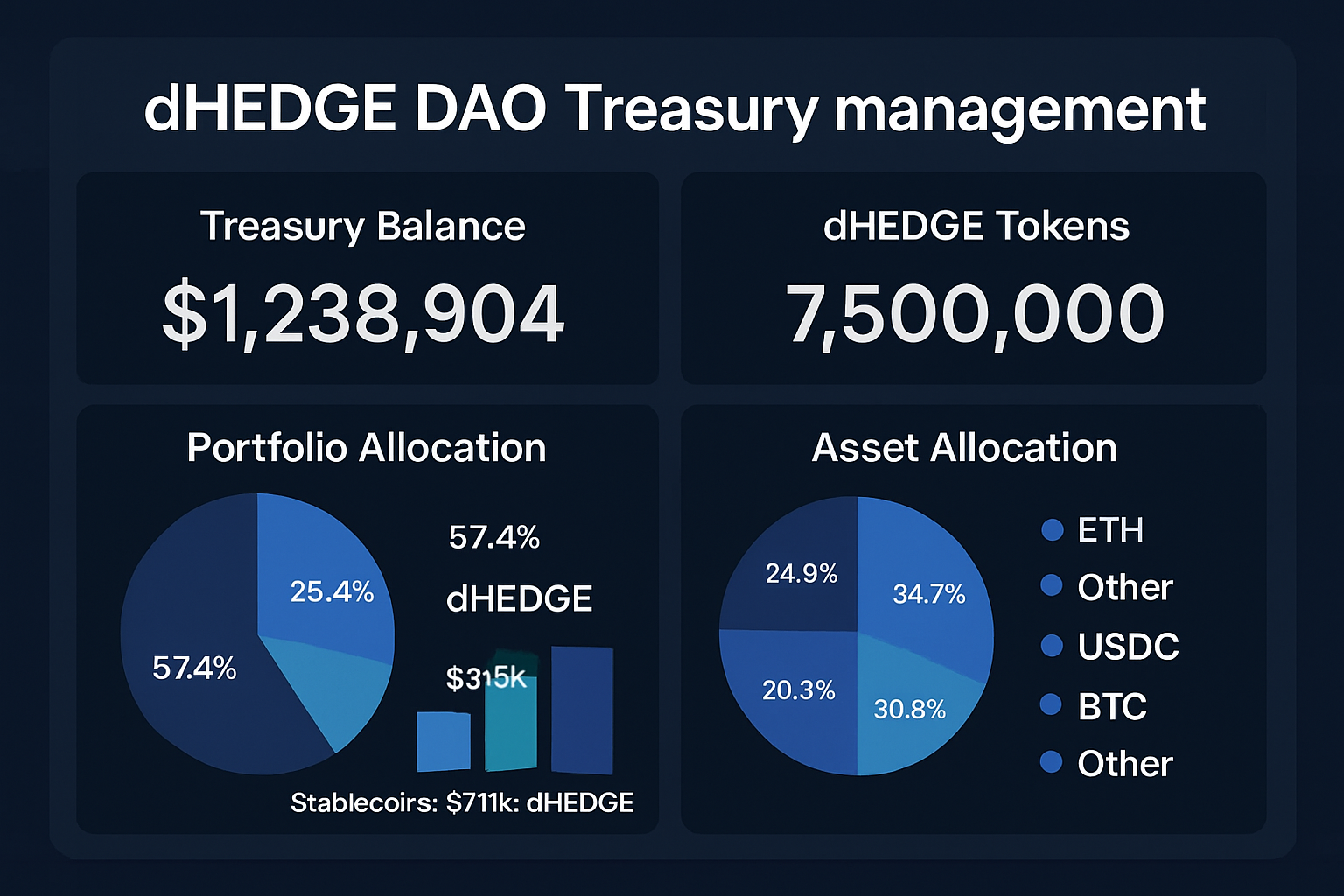

Selecting the Right Platforms: Factor. fi, Aera and dHEDGE in Focus

The rise of specialized platforms has democratized access to sophisticated vault infrastructure once reserved for institutional funds. Here are three leading options tailored for DAOs:

Key Features of Factor.fi, Aera, and dHEDGE for DAO Treasuries

-

Factor.fi: Modular, Automated Vaults – Factor.fi enables DAOs to build customizable, programmable vaults that align with specific risk profiles and capital goals. The platform supports automated rebalancing and yield optimization across major DeFi protocols such as GMX, Aave, Curve, and Balancer, allowing DAOs to efficiently diversify and manage assets.

-

Aera: Autonomous, Non-Custodial Vault Management – Aera offers autonomous vaults where DAOs can delegate treasury management to a decentralized network. Vault guardians set allocation parameters, while arbitrageurs maintain target allocations by executing trades. Aera’s vaults are currently available on the Polygon network and are designed for non-custodial, transparent operations.

-

dHEDGE: Multichain DeFi Strategy Integration – dHEDGE allows DAOs to implement automated strategies like managed liquidity, stablecoin yield farming, and lending. It supports multichain exposure across Ethereum Mainnet, Polygon, and Optimism, giving DAOs access to a broad range of DeFi protocols and yield opportunities through a single platform.

Factor. fi vaults offer modularity and programmable strategies with automated rebalancing across DeFi blue chips like GMX and Curve. Aera vaults on Polygon introduce decentralized guardianship, asset allocation parameters set by trusted participants while arbitrageurs keep portfolios balanced. dHEDGE integrates multichain yield farming and lending strategies, unlocking both diversification and yield optimization at scale.

Choosing a platform is only the beginning. The real edge comes from designing automated strategies that are both resilient and adaptive. DAOs should focus on dynamic diversification across stablecoins and protocols, while leveraging vaults that support periodic rebalancing to respond to market shifts. This approach minimizes concentration risk and maximizes yield capture without sacrificing liquidity or security.

Governance, Security, and Community Oversight

No automation strategy is complete without robust governance. Multi-signature wallets remain the gold standard for transaction approvals, but leading DAOs are layering in role-based access controls and granular permissions to further reduce attack surfaces. Regular smart contract audits, both internal and via third parties, are non-negotiable for safeguarding treasury assets.

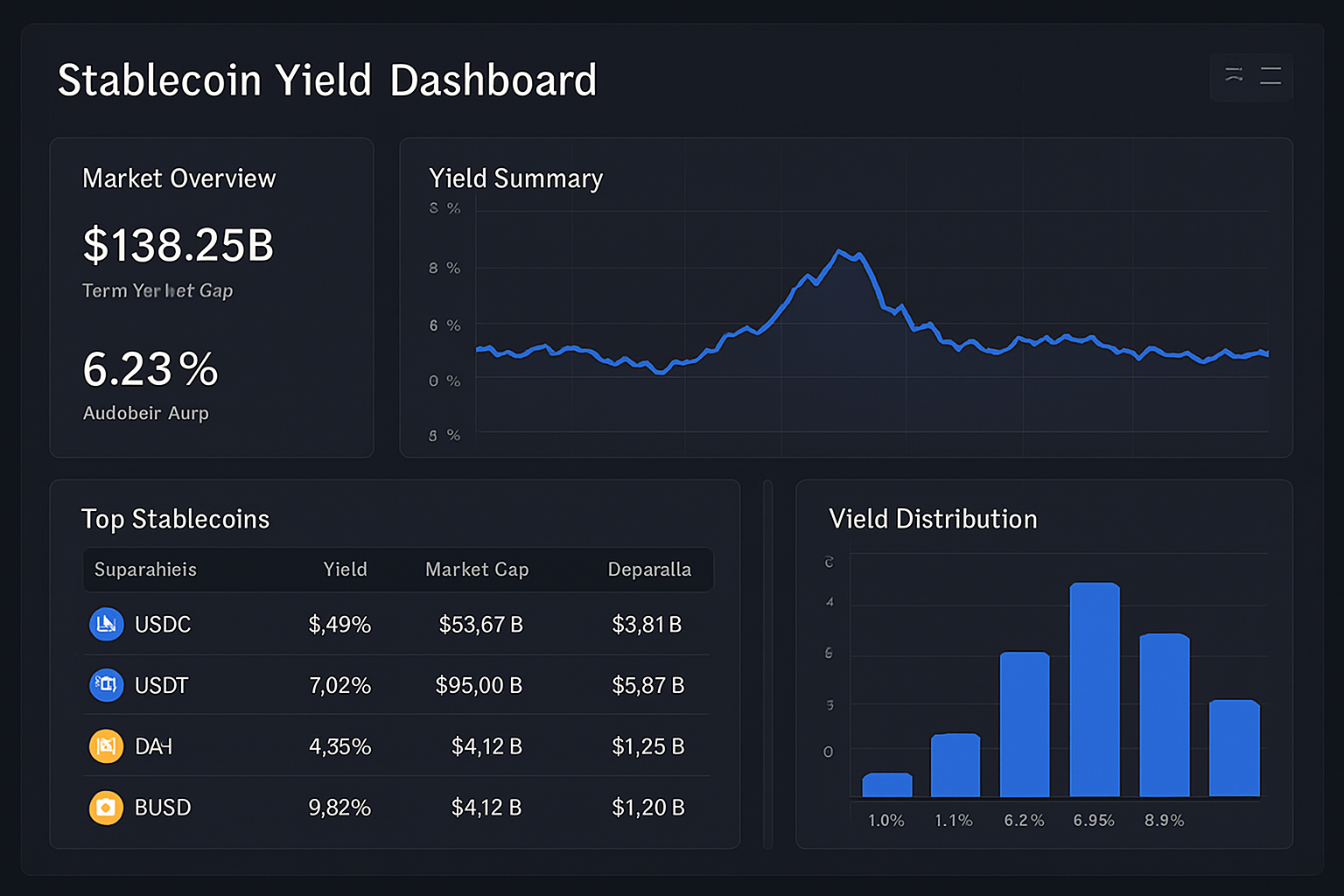

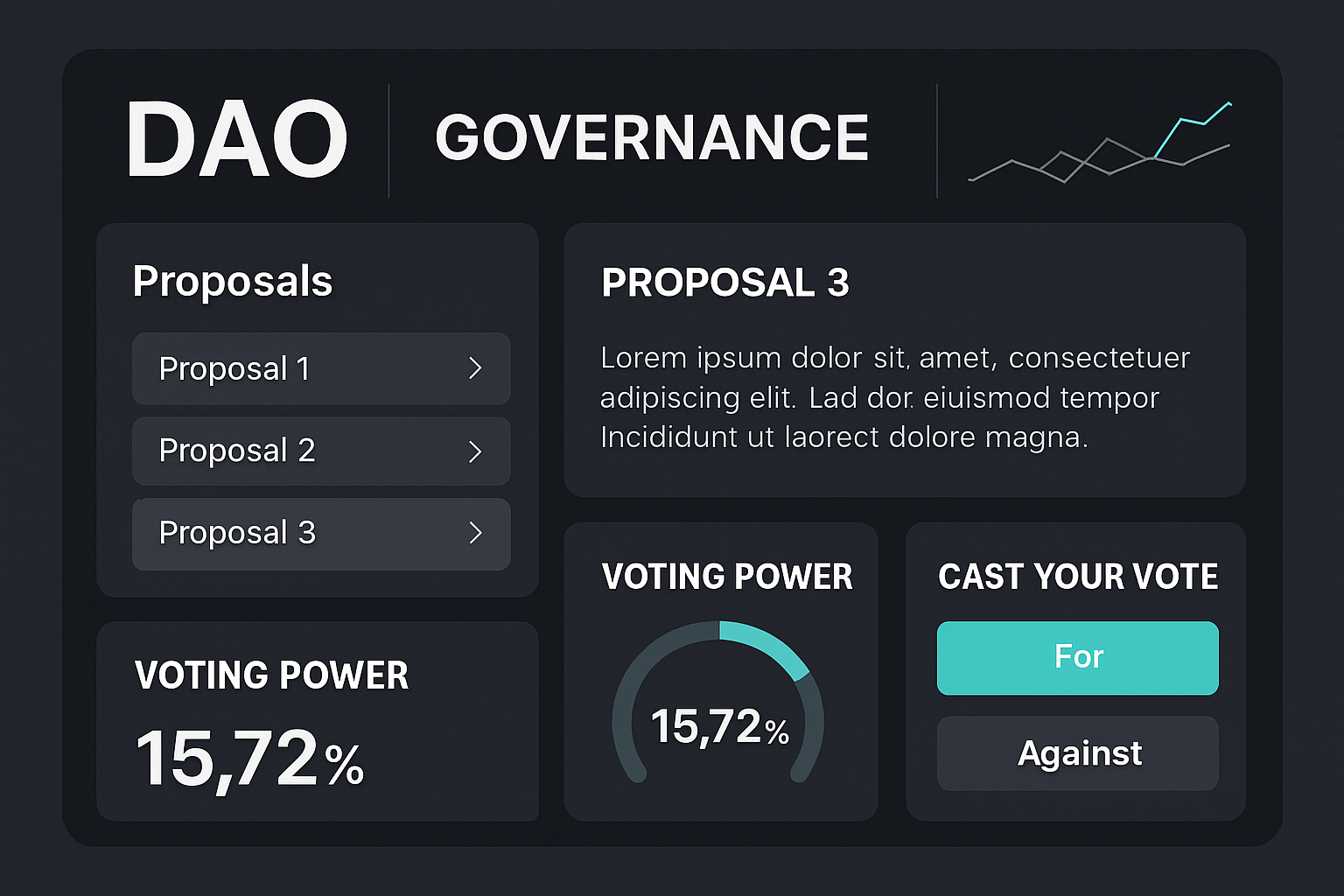

Transparency is also paramount. By integrating analytics dashboards, DAOs can provide real-time reporting on yield performance, allocation breakdowns, and protocol exposure, empowering members to make informed decisions. Community involvement in governance votes around treasury allocation helps align incentives and reinforces trust in on-chain processes.

Monitoring Performance and Iterating on Strategy

The best-run DAOs treat treasury automation as a living system, one that requires constant monitoring and iterative refinement. Key performance indicators (KPIs) like annualized yield, volatility-adjusted returns, protocol risk scores, and deviation from target allocations should be tracked continuously using specialized analytics tools.

If yield falls below expectations or market volatility spikes, automated triggers can rebalance allocations or migrate assets to safer protocols. This agility transforms DAOs from passive capital pools into active stewards of digital wealth.

Top KPIs for DAO Stablecoin Vault Performance

-

Net Annualized Yield: Measures the actual annual return generated by the vault after fees. This KPI indicates the effectiveness of yield strategies and is essential for evaluating treasury growth.

-

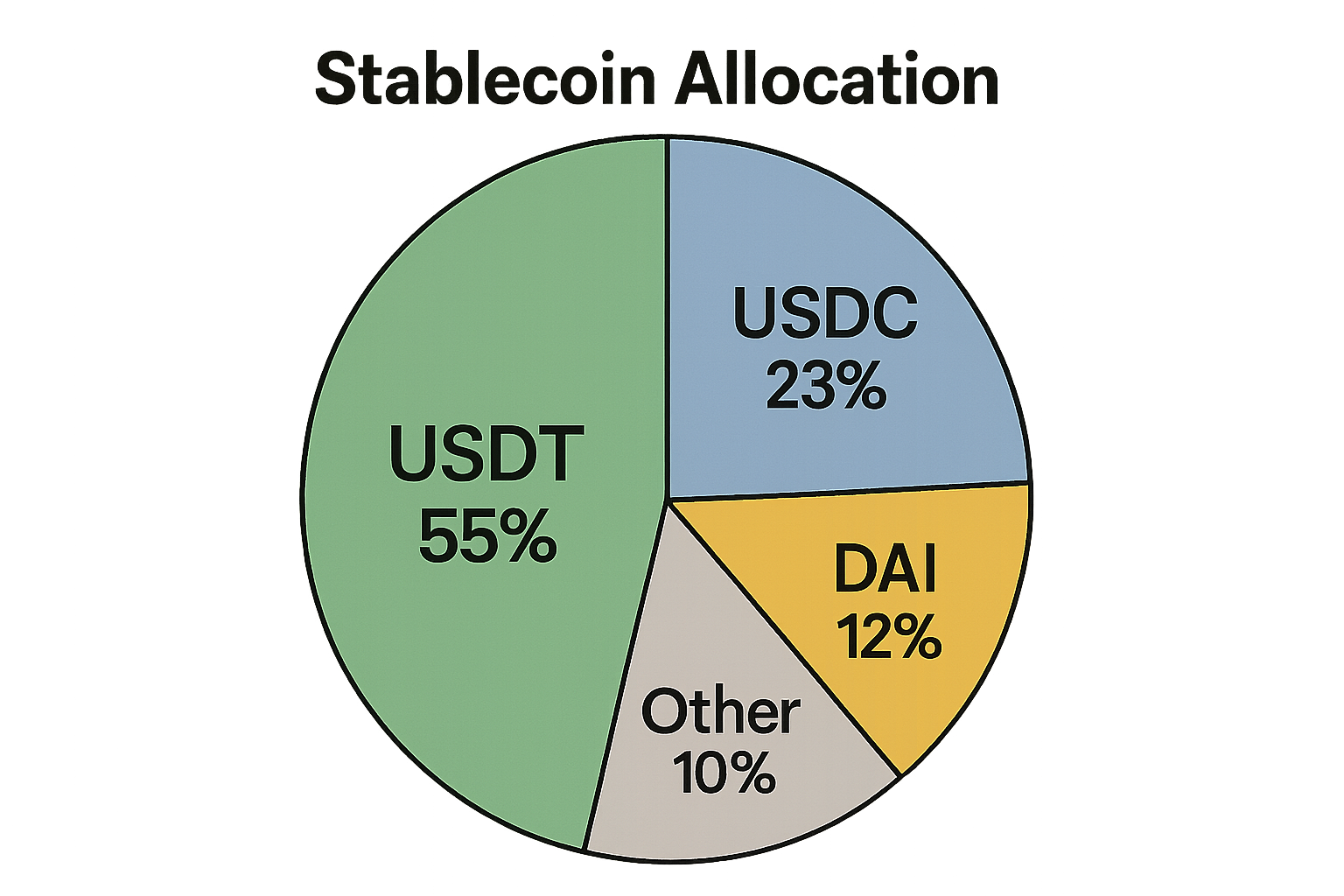

Stablecoin Diversification Ratio: Tracks the percentage allocation across different stablecoins (e.g., USDC, DAI, USDT). A higher diversification ratio helps mitigate risks related to any single stablecoin depegging or protocol failure.

-

Vault Asset Allocation: Monitors the distribution of assets across DeFi protocols (such as Aave, Curve, Compound) and liquidity pools. This KPI ensures alignment with the DAO’s risk profile and strategic objectives.

-

Rebalancing Frequency & Efficiency: Evaluates how often and how effectively the vault rebalances assets to maintain target allocations. Efficient rebalancing minimizes slippage and maximizes returns.

-

Smart Contract Security Incidents: Tracks the number and severity of security issues, audits, or breaches affecting the vault. This KPI is critical for assessing operational risk and treasury safety.

-

Governance Participation Rate: Measures the proportion of DAO members actively involved in treasury-related votes and proposals. High participation indicates robust community oversight and transparency.

-

Liquidity Availability: Assesses the ease with which assets can be converted to cover operational expenses or strategic investments. High liquidity ensures the DAO can respond quickly to opportunities or emergencies.

The Road Ahead: Capital Efficiency Meets Composable Security

The convergence of automated stablecoin vaults with advanced governance frameworks marks a new era in DAO treasury management. As DeFi infrastructure matures, expect to see even tighter integrations between vault platforms, analytics suites, and community voting modules, enabling treasuries to operate with both institutional rigor and decentralized ethos.

The organizations that thrive will be those who embrace automation not as a shortcut but as an opportunity to hard-code discipline into their financial operations, freeing up human capital for high-impact decision-making while letting smart contracts handle the rest.