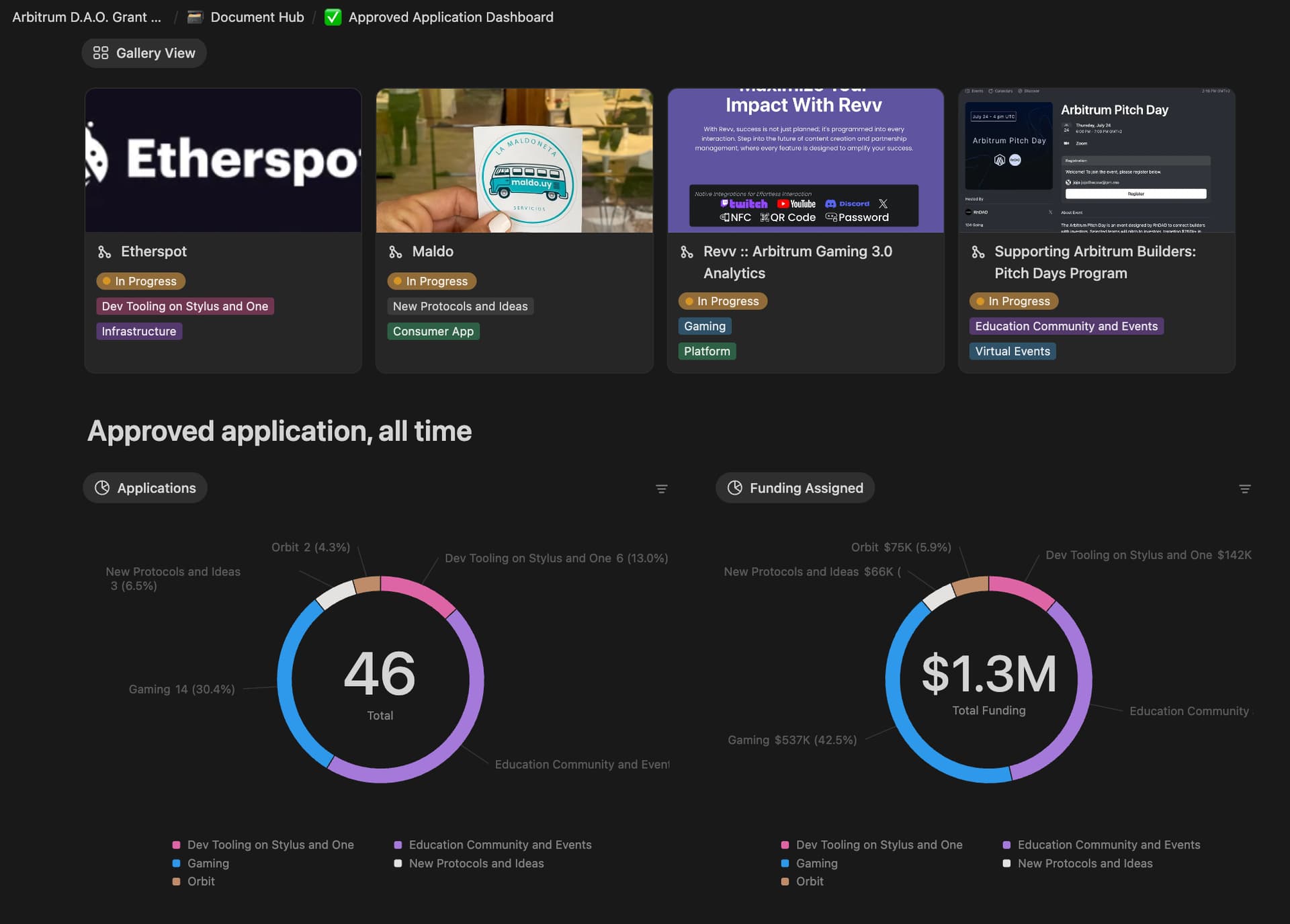

Arbitrum DAO stands at the forefront of on-chain treasury management, demonstrating how decentralized organizations can generate sustainable yield while maintaining robust risk controls. With a treasury exceeding $1.3 billion, Arbitrum DAO’s approach serves as a case study for other DAOs seeking to balance capital efficiency and long-term sustainability.

Leveraging On-Chain Yield Strategies in a $1.3B Treasury

Arbitrum DAO’s treasury management program is intentionally diverse, blending DeFi-native strategies with tokenized real-world asset (RWA) exposure. The Stable Treasury Endowment Program (STEP), launched in July 2024, marked a pivotal shift: over $30 million was allocated into institutional-grade RWAs such as BlackRock’s BUIDL, Ondo’s USDY, and Mountain Protocol’s USDM. In less than a year, these investments generated nearly $700,000 in passive yield, all tracked transparently on-chain.

In May 2025, Arbitrum DAO expanded STEP by allocating an additional 35 million ARB (approximately $15.5 million) into tokenized U. S. Treasury products through Franklin Templeton, Spiko, and WisdomTree. This strategic move not only diversifies the treasury but also increases exposure to low-volatility yield sources, an essential buffer against crypto market swings.

How Sustainable Yield Is Generated On-Chain

The core of Arbitrum DAO’s yield generation lies in its multi-pronged strategy:

- DeFi Lending and Staking: Utilizing protocols such as Aave and Lido to earn interest or staking rewards on idle assets.

- Liquidity Provisioning: Providing liquidity to select pools for fee income while managing impermanent loss risk.

- Tokenized RWA Exposure: Allocating funds to regulated products like BlackRock’s BUIDL or Franklin Templeton’s on-chain Treasuries for stable yields tied to traditional finance instruments.

This approach is not just about maximizing returns; it is about sustainable, risk-adjusted growth that aligns with the DAO’s mission to support ecosystem development and maintain operational resilience.

Arbitrum (ARB) Price Prediction 2026-2031

Comprehensive outlook based on current market data, DAO treasury management strategies, and evolving DeFi adoption.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-over-Year % Change (Avg) | Market Insights / Scenario |

|---|---|---|---|---|---|

| 2026 | $0.35 | $0.52 | $0.85 | +17% | Recovery phase; sustainable yield from STEP and RWAs stabilizes ecosystem, gradual DeFi growth |

| 2027 | $0.40 | $0.65 | $1.10 | +25% | Increased RWA adoption, higher DeFi usage, and DAO governance innovation drive moderate growth |

| 2028 | $0.48 | $0.81 | $1.35 | +25% | Broader institutional integration; regulatory clarity around RWAs boosts on-chain activity |

| 2029 | $0.60 | $1.04 | $1.70 | +28% | Bull cycle potential; Arbitrum cements position as leading L2 for DeFi, DAO treasury growth accelerates |

| 2030 | $0.75 | $1.28 | $2.10 | +23% | Expansion of STEP and major DeFi partnerships, cross-chain interoperability matures |

| 2031 | $0.90 | $1.55 | $2.55 | +21% | Sustained adoption, mature DAO treasury model, and broad RWA integration into DeFi |

Price Prediction Summary

Arbitrum (ARB) is positioned for progressive growth over the next six years, supported by innovative treasury management (STEP), real-world asset (RWA) integration, and growing DeFi adoption. While the token faces competitive and regulatory risks, its robust DAO structure and ecosystem sustainability efforts provide a solid foundation. ARB could see a steady climb with potential for significant upside during bullish market cycles, especially as institutional and on-chain finance converge.

Key Factors Affecting Arbitrum Price

- Sustainable yield from DAO-managed RWAs (STEP) enhances financial stability and investor confidence.

- Expansion of DeFi and RWA adoption could drive demand for ARB and ecosystem growth.

- Regulatory developments around tokenized assets and DAOs may introduce volatility but also clarity.

- Technological innovation in L2 scaling and cross-chain interoperability strengthens Arbitrum’s value proposition.

- Market cycles and broader crypto sentiment will influence price ranges and volatility.

- Competition from other L2s and evolving DeFi protocols could impact ARB’s market share and price potential.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Role of Governance and Transparency

A distinguishing feature of Arbitrum DAO treasury management is its transparent governance process. Every significant allocation, whether to DeFi protocols or RWAs, must pass through community proposals and votes. For example, the expansion of STEP in May 2025 was subject to extensive debate within the Arbitrum Governance Forum, ensuring alignment with both risk parameters and long-term objectives.

This open process fosters accountability while enabling real-time adjustments as market conditions evolve. It also empowers ARB holders and delegates to shape the capital strategy directly, a model other DAOs are increasingly emulating (source).

Market Context: ARB Price Dynamics and Treasury Implications

The effectiveness of any on-chain treasury strategy depends partly on underlying asset prices. As of today, Arbitrum (ARB) trades at $0.4453, up 0.0108% over the last 24 hours (24h high: $0.4563; low: $0.4346). This relative stability supports the DAO’s efforts to allocate portions of its native token into yield-generating strategies without excessive volatility drag.

The combination of real-time analytics, diversified allocations, and transparent governance makes Arbitrum DAO a bellwether for sustainable on-chain treasury management.

– Sophie Caldwell or On-Chain Treasuries

With market conditions evolving rapidly, the DAO’s approach to risk management and real-time analytics is key. The Treasury and Sustainability Working Group continuously monitors exposures, scenario models, and liquidity needs to ensure that yield generation does not come at the expense of solvency or growth capital. This includes stress-testing RWA allocations against macroeconomic shifts and maintaining flexible rebalancing frameworks for DeFi protocol positions.

Balancing Capital Efficiency with Risk Controls

Capital efficiency is not just about maximizing yield – it’s about optimizing every dollar (or ARB) in the treasury to serve the DAO’s mission. By allocating a mix of stablecoins, native ARB, and tokenized U. S. Treasuries, Arbitrum DAO can:

Key Benefits of Arbitrum DAO’s Diversified Treasury Management

-

Sustainable Yield Generation: By allocating over $30 million to tokenized real-world assets (RWAs) like BlackRock’s BUIDL, Ondo’s USDY, and Mountain Protocol’s USDM through the Stable Treasury Endowment Program (STEP), Arbitrum DAO has generated nearly $700,000 in passive yield since July 2024.

-

Institutional-Grade Asset Exposure: Strategic investments in products from Franklin Templeton, Spiko, and WisdomTree give the DAO access to regulated, institutional-quality U.S. Treasury products, enhancing trust and stability for the treasury.

-

Risk Mitigation Through Diversification: By spreading treasury assets across multiple DeFi protocols and RWAs, the DAO reduces reliance on any single platform or asset, helping to manage volatility and safeguard funds.

-

Support for On-Chain RWA Adoption: Arbitrum DAO’s investments foster the growth of tokenized real-world assets on-chain, encouraging broader adoption and integration of traditional finance with DeFi.

-

Empowered Community Governance: With over $1.3 billion in assets, Arbitrum DAO enables ARB holders and delegates to shape treasury strategy, ensuring decisions reflect the community’s long-term interests.

This balanced deployment ensures that the DAO can fund grants, incentives, and ecosystem initiatives while keeping a robust reserve for market downturns. The STEP program’s focus on highly liquid RWAs also means assets can be quickly reallocated or redeemed if opportunities or risks emerge.

What Sets Arbitrum DAO Apart?

While many DAOs have experimented with DeFi yield strategies, Arbitrum’s scale and governance rigor set it apart. Every major allocation is debated publicly; risk parameters are codified on-chain; performance metrics are accessible to all stakeholders in real time. This transparency not only builds trust but also enables continuous improvement as new protocols or asset classes emerge.

Arbitrum DAO further distinguishes itself by being an early adopter of institutional-grade RWAs on-chain – a trend that could define the next era of DeFi treasury management (source). By bridging traditional finance with decentralized governance, the DAO opens up new avenues for sustainable growth.

Lessons for Other DAOs

For DAOs seeking to emulate Arbitrum’s success in on-chain treasury management, several best practices stand out:

- Prioritize transparency: Make every allocation process visible and auditable by the community.

- Diversify across DeFi and RWAs: Don’t rely solely on crypto-native yields; explore regulated tokenized assets for stability.

- Implement real-time analytics: Use dashboards to track performance, risk metrics, and liquidity at all times.

- Iterate governance frameworks: Regularly revisit risk parameters as new strategies or products become available.

The future of DAO capital efficiency will depend on how well treasuries like Arbitrum’s continue to innovate while safeguarding their core assets. As more institutional products migrate on-chain and analytics tools mature, expect even greater sophistication in how decentralized organizations manage their war chests. For now, Arbitrum DAO stands as a leading example of what is possible when transparency meets disciplined diversification in the world of decentralized finance.