DAO stablecoin vault optimization is evolving rapidly in 2024, driven by the need for sustainable yield and robust risk management. The DeFi landscape now offers a wealth of protocols and tools tailored for decentralized treasury operations, but navigating this complexity requires strategic focus. Below, we break down the top five actionable strategies every DAO should implement to maximize stablecoin yields while minimizing exposure to protocol and market risks.

1. Diversify Stablecoin Allocations Across Top Yield Aggregators

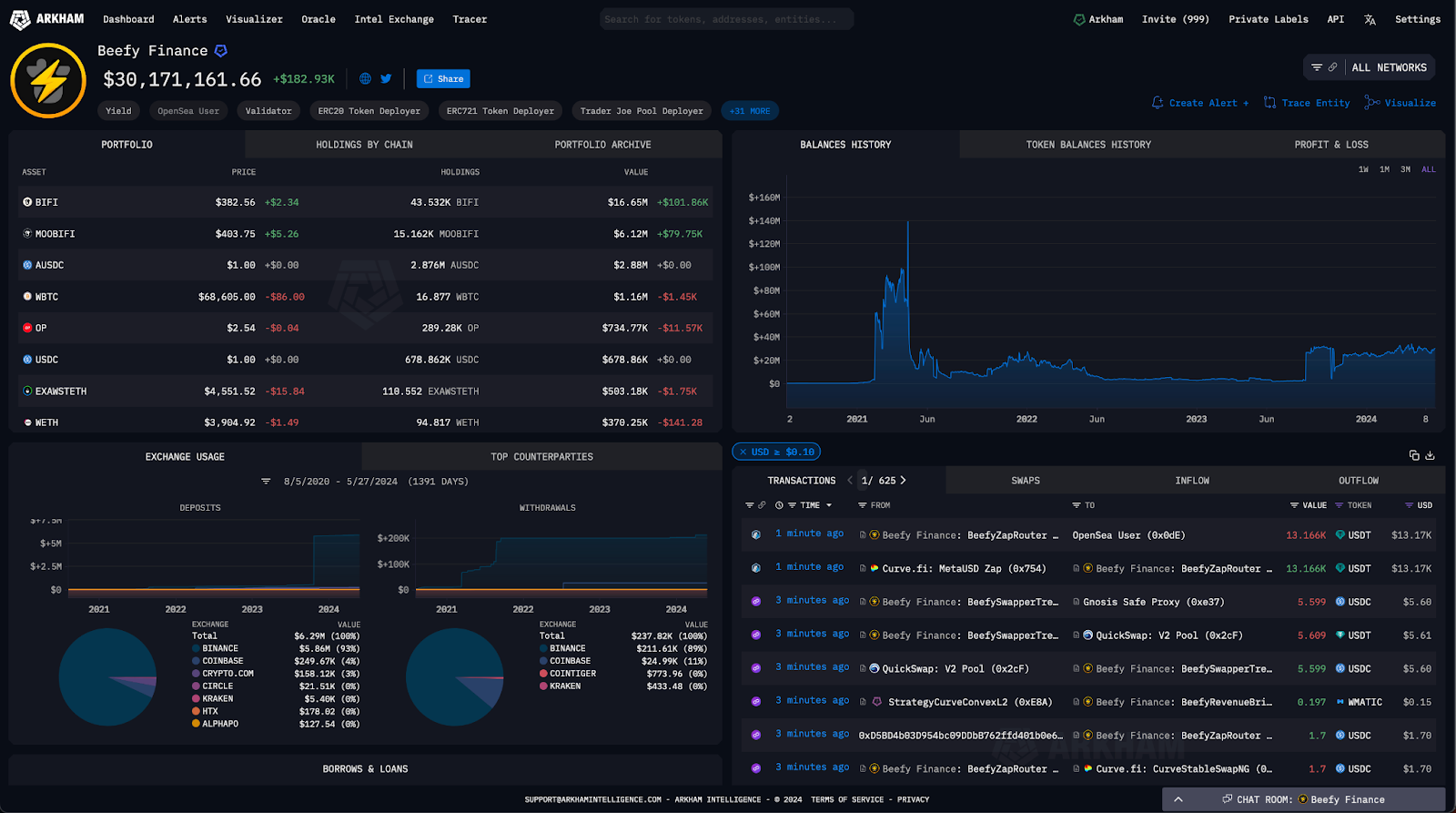

Concentration risk is a DAO treasury’s silent adversary. By spreading assets across multiple leading yield aggregators such as Yearn, Beefy, and Morpho, DAOs can capture competitive APYs while insulating their vaults from single-protocol exploits or underperformance. For example, Beefy Finance currently advertises up to 25% on select stablecoin vaults, while Morpho offers rates above 23%: but these numbers fluctuate with liquidity and protocol health. Diversification not only smooths out return volatility but also ensures that a DAO’s capital remains productive even if one aggregator faces downtime or security issues.

Top Yield Aggregators for DAOs in 2024

-

Diversify Stablecoin Allocations Across Top Yield Aggregators (e.g., Yearn, Beefy, Morpho) to capture competitive rates and mitigate protocol risk. By spreading assets across multiple leading platforms, DAOs can reduce exposure to single-platform vulnerabilities and optimize for the best available yields.

-

Utilize Automated Rebalancing Tools for dynamic vault allocation based on real-time APY and risk metrics. Platforms like DeFiLlama and Instadapp Lite provide automation and analytics to help DAOs adjust positions efficiently as market conditions change.

-

Prioritize Low-Slippage, High-Liquidity Pools (e.g., Curve, Uniswap V3 Stablecoin Pools) to maximize yield while minimizing impermanent loss. These pools are engineered for stablecoin trading, offering deep liquidity and efficient swaps crucial for large DAO treasury operations.

-

Implement DAO Governance Controls for treasury withdrawals and allocations using multi-sig and on-chain voting mechanisms. Tools like Gnosis Safe and Snapshot ensure secure, transparent, and decentralized treasury management.

To execute this effectively:

- Allocate stablecoins proportionally based on real-time APY and TVL metrics.

- Regularly reassess allocations as new protocols or vaults emerge.

- Monitor platform audits and community reputation to avoid newly-launched or unaudited aggregators unless risk appetite allows.

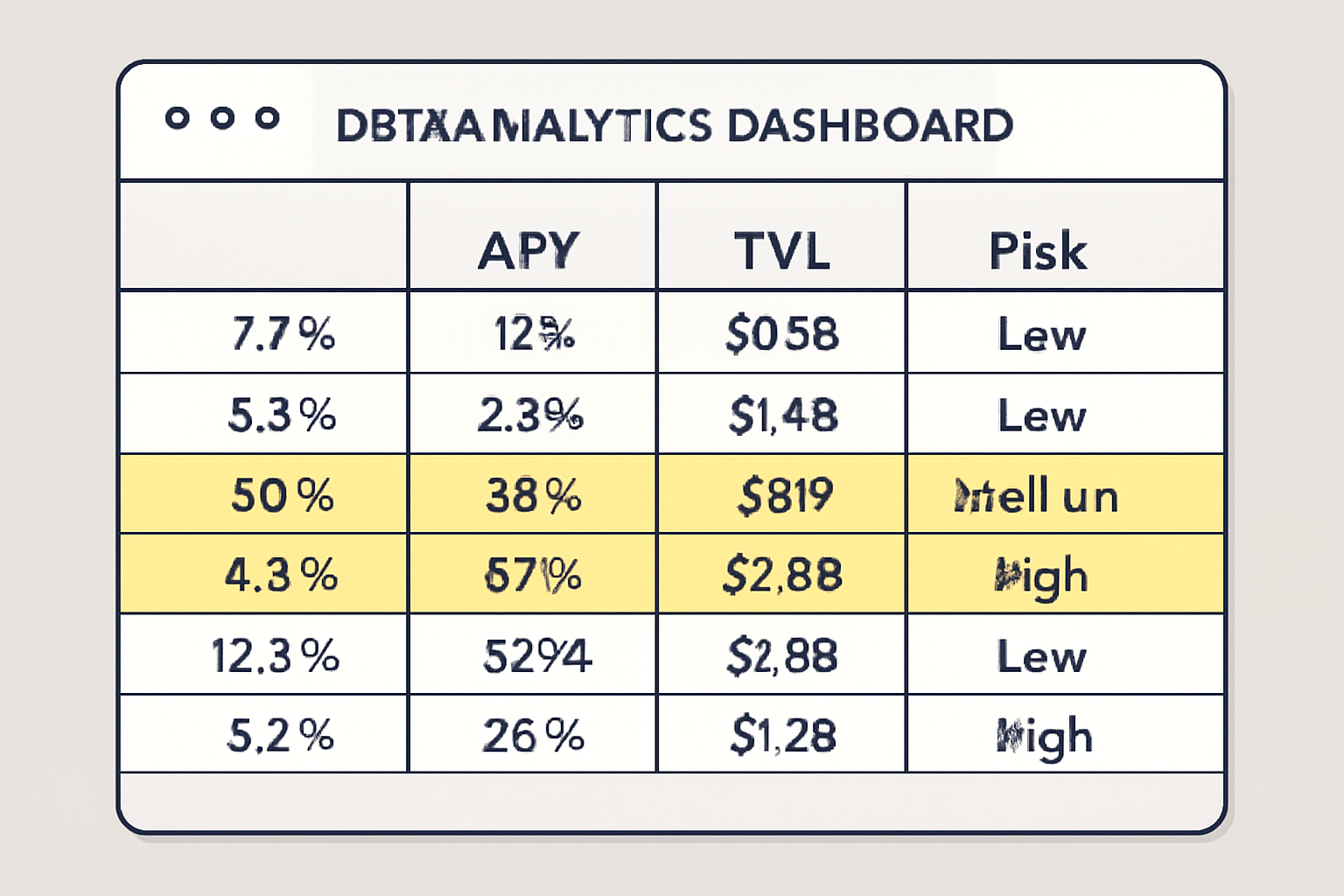

2. Utilize Automated Rebalancing Tools for Dynamic Vault Allocation

The rise of automated rebalancing tools has been transformative for on-chain treasury management. These tools continuously scan the DeFi ecosystem for optimal yield opportunities and dynamically shift allocations based on live APY data, risk scores, and liquidity conditions. By leveraging platforms that offer automated rebalancing, often with built-in risk analytics, DAOs can reduce manual oversight while ensuring capital is never idle or overexposed to declining pools.

This approach is especially effective in volatile markets where yield differentials between platforms can change within hours. Automation also helps DAOs avoid human error and governance delays when reallocating funds between vaults or aggregators.

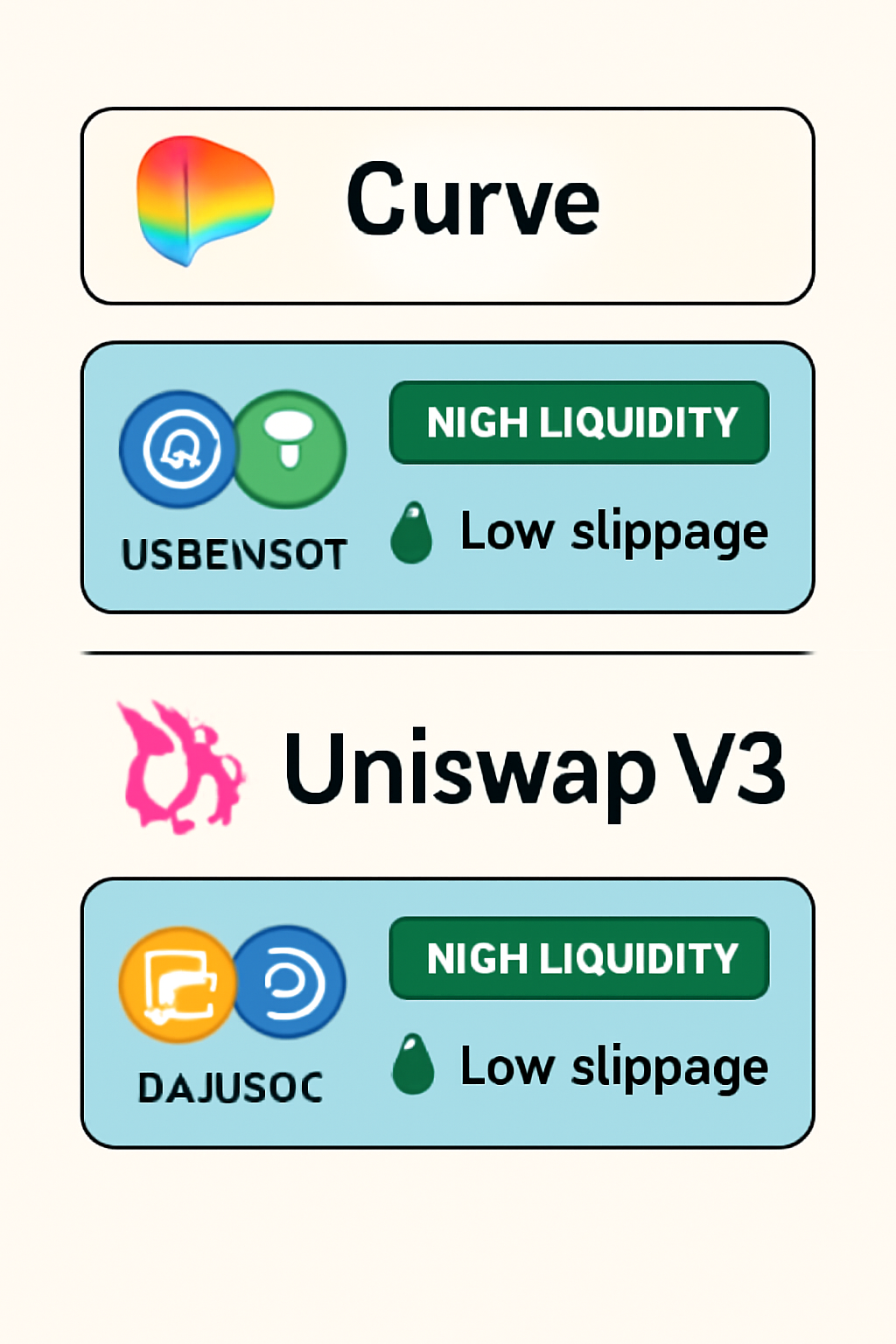

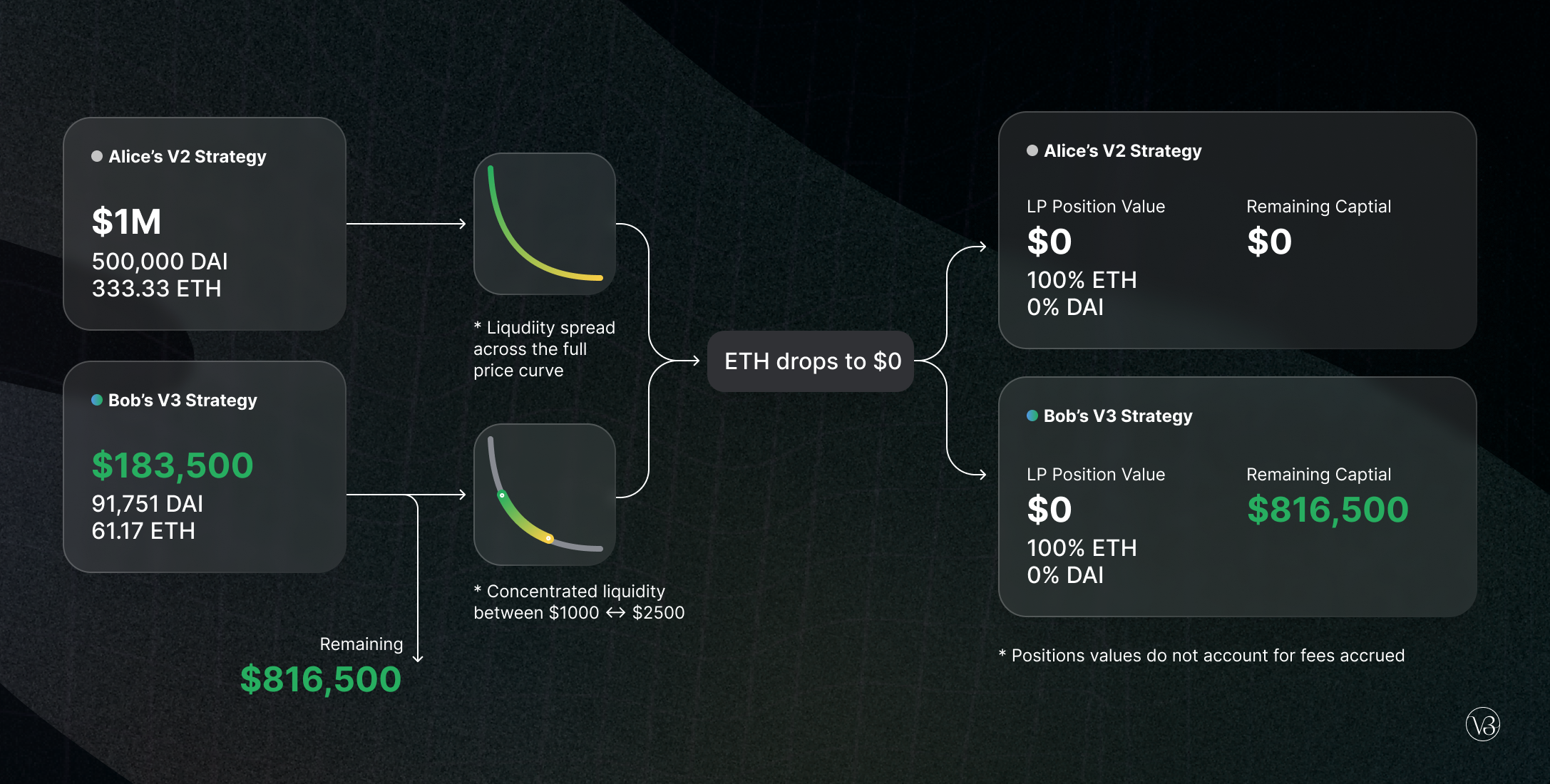

3. Prioritize Low-Slippage, High-Liquidity Pools

Yield means little if it comes at the cost of high slippage or impermanent loss. For DAOs seeking consistent returns on their stablecoins, routing allocations through low-slippage pools like Curve Finance or Uniswap V3’s concentrated liquidity pools is essential. Curve’s design focuses exclusively on stablecoins, offering deep liquidity with minimal price impact, a key factor in maximizing net returns when entering or exiting positions.

- Select pools with high total value locked (TVL) to ensure exit liquidity during market stress events.

- Monitor pool utilization rates; overutilized pools may offer higher yields but carry increased withdrawal risks during black swan events.

This strategy directly reduces hidden costs that erode yield over time, especially important for large DAOs managing multi-million dollar treasuries.

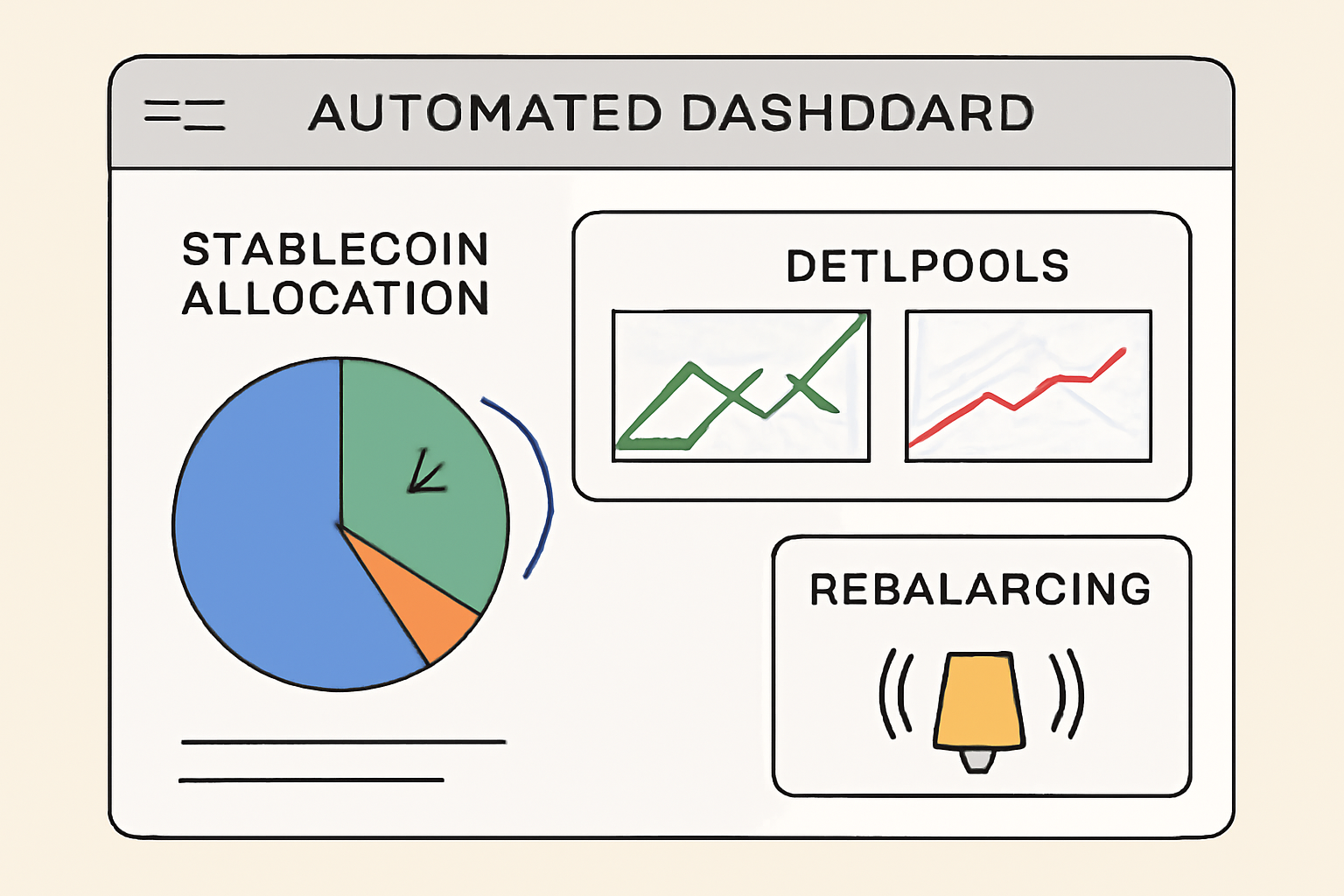

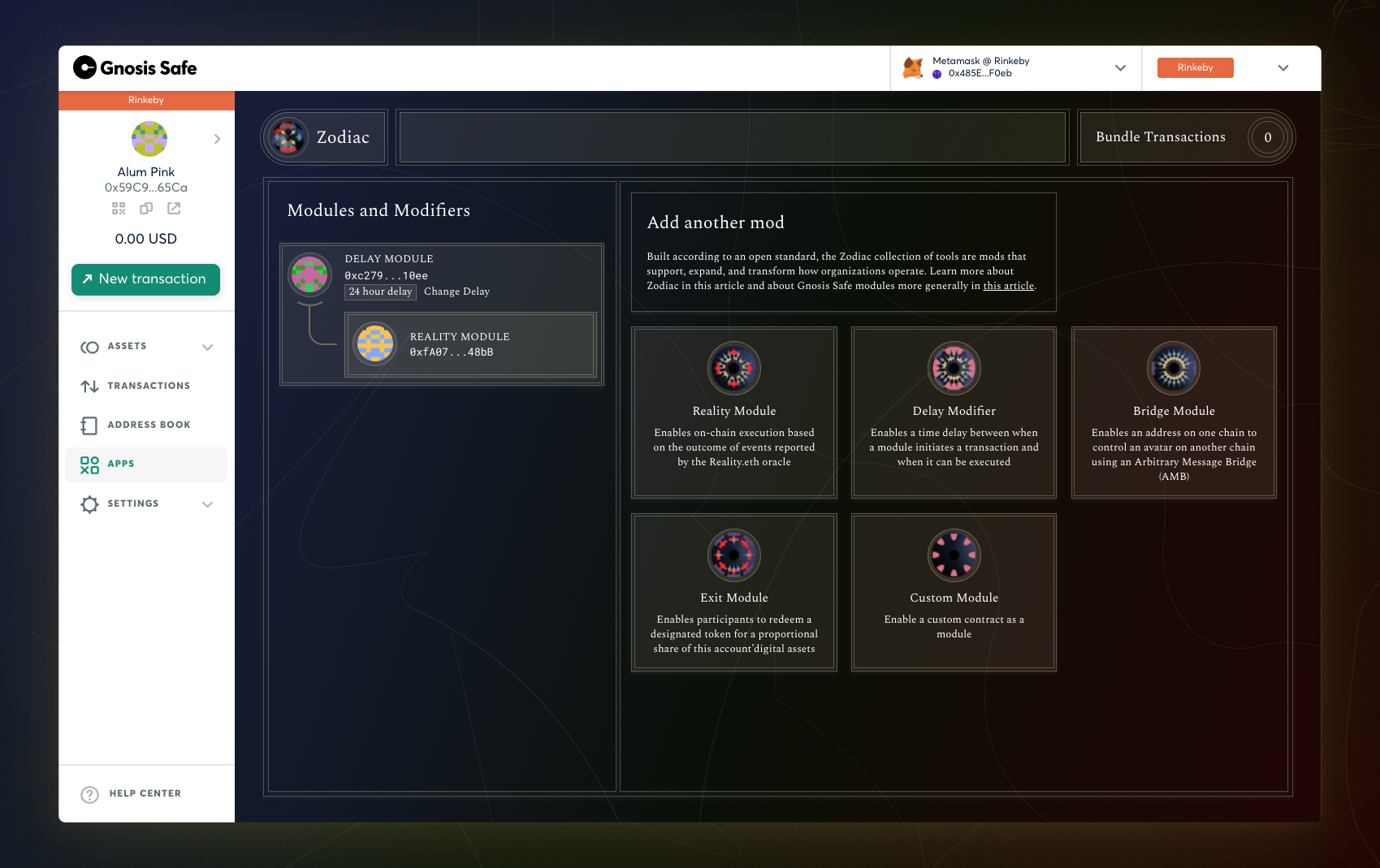

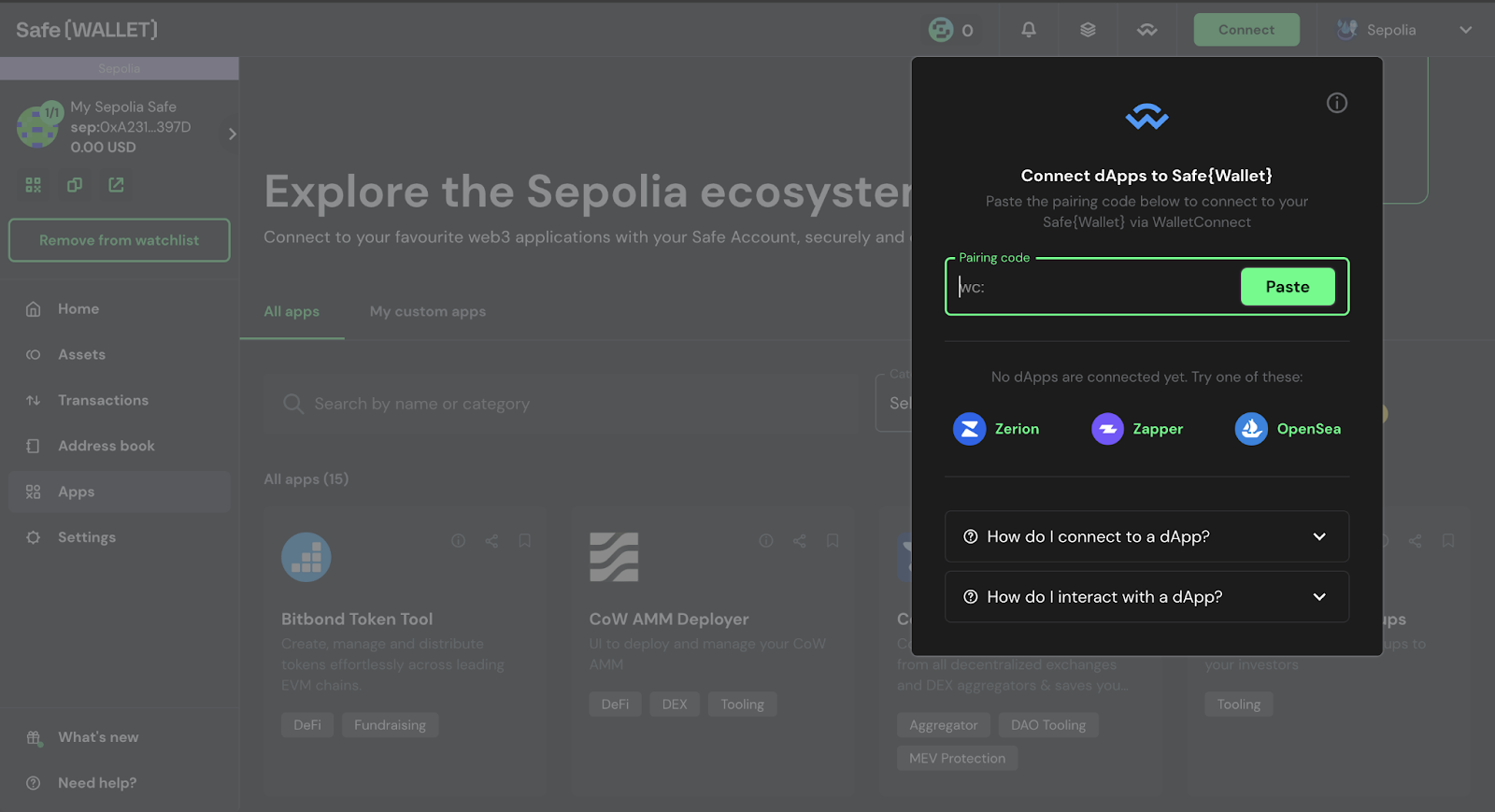

4. Implement DAO Governance Controls for Treasury Withdrawals and Allocations

Robust on-chain governance is non-negotiable for DAOs seeking to balance agility with security in treasury operations. Multi-signature (multi-sig) wallets and on-chain voting mechanisms create transparent, auditable workflows for all stablecoin vault movements. This not only deters internal collusion and unauthorized withdrawals but also builds trust among DAO members and external stakeholders.

- Require multiple signers (e. g. , 4-of-7 multi-sig) for any material allocation or withdrawal from treasury vaults.

- Automate proposal execution through smart contracts, ensuring that only approved strategies are enacted.

- Integrate real-time analytics dashboards so token holders can monitor treasury activity and governance outcomes.

As DAOs scale, these controls become the backbone of sustainable growth, enabling rapid response to market changes without sacrificing transparency or security. Leading protocols like Gnosis Safe and Tally have set the standard for integrating multi-sig and on-chain voting directly into DAO workflows, making it easier than ever to implement these best practices.

5. Optimize Fee Structures with Gas-Efficient Layer 2s and Low-Fee Protocols

Yield erosion from high management fees, performance cuts, or gas costs can quietly sap a DAO’s long-term returns. In 2024, optimizing fee structures is not just about picking the highest-yielding protocol but also about selecting those with low overhead. Many top aggregators now operate on Layer 2 solutions like Arbitrum or Optimism, which dramatically reduce transaction costs compared to Ethereum mainnet.

- Prioritize protocols with transparent fee disclosures, look for platforms charging under 1% in management/performance fees when possible.

- Leverage aggregators that batch transactions or use rollups to minimize gas expenditure per allocation or rebalance event.

- If operating across multiple chains, use bridges with proven track records to avoid unnecessary slippage or cross-chain risk.

The compounding effect of lower fees can boost net APY by several percentage points over a year, a difference that’s especially significant for large treasuries. For practical examples of how DAOs are optimizing fees while maintaining security standards in their stablecoin strategies, see the deep dives at ProTechBro’s DeFi strategy guide.

Top 5 DAO Stablecoin Vault Optimization Strategies

-

Diversify Stablecoin Allocations Across Top Yield Aggregators (e.g., Yearn, Beefy, Morpho) to capture competitive rates and mitigate protocol risk. By distributing assets among multiple leading aggregators, DAOs reduce exposure to individual platform vulnerabilities while optimizing yield opportunities across DeFi ecosystems.

-

Utilize Automated Rebalancing Tools for dynamic vault allocation based on real-time APY and risk metrics. Automated tools and smart contracts can monitor market conditions, reallocating stablecoins to protocols offering the best risk-adjusted returns, thereby enhancing efficiency and minimizing manual intervention.

-

Prioritize Low-Slippage, High-Liquidity Pools (e.g., Curve, Uniswap V3 Stablecoin Pools) to maximize yield while minimizing impermanent loss. Selecting pools with deep liquidity and minimal price impact ensures stable returns and reduces the risk of value erosion during volatile market conditions.

-

Implement DAO Governance Controls for treasury withdrawals and allocations using multi-sig and on-chain voting mechanisms. Robust governance frameworks safeguard assets, enable transparent decision-making, and prevent unauthorized access to vault funds.

-

Optimize Fee Structures by selecting protocols with low management/performance fees and leveraging gas-efficient Layer 2 solutions. Minimizing operational costs through careful protocol selection and transaction optimization directly increases net vault yields for DAO participants.

Best Practices: Sustainable Yield and Risk Management in On-Chain Treasuries

The most advanced DAOs treat stablecoin vaults as living portfolios, constantly monitored, dynamically allocated, and governed by transparent rulesets. Combining diversified aggregator exposure with automated rebalancing ensures capital is always working efficiently; prioritizing low-slippage pools protects against hidden losses; rigorous governance keeps assets secure; and relentless fee optimization preserves every basis point of yield.

For DAOs ready to take their on-chain treasury management to the next level in 2024:

- Avoid complacency: Regularly review new protocols and Layer 2 solutions entering the market.

- Automate wisely: Use automation as a force multiplier but maintain human oversight via governance checkpoints.

- Measure everything: Track KPIs such as net APY after fees, withdrawal latency during stress events, and protocol audit status.

- Diversify defensively: Don’t chase yield at the expense of security, balance is key to long-term sustainability.

The DeFi ecosystem will only grow more complex, but by anchoring your DAO’s stablecoin strategy around these five core pillars, you’ll be positioned not just to survive but thrive in an era where capital efficiency and on-chain trust define success.