Auditing DAO treasury transactions is the cornerstone of trust in decentralized finance. With every asset movement and governance action recorded on-chain, DAOs have the unique opportunity to achieve a level of transparency that far exceeds traditional organizations. Yet, this transparency is only meaningful if paired with rigorous audit processes and clear communication to stakeholders. In this article, we’ll break down actionable steps and best practices for maximizing on-chain treasury transparency, empowering DAO operators, treasury managers, and community members alike.

Key Pillars of DAO Treasury Auditing

Effective DAO transaction audit frameworks are built on several core pillars: regular audits, robust wallet security, transparent reporting, real-time risk detection, and immutable records. Let’s examine each in detail.

Key Benefits of Transparent DAO Treasury Audits

-

Enhanced Community Trust: Transparent audits allow DAO members to independently verify all treasury transactions, fostering a culture of trust and openness within the organization.

-

Improved Accountability: With every transaction and decision recorded on a public blockchain, members and regulators can hold contributors accountable for their actions, reducing the risk of mismanagement.

-

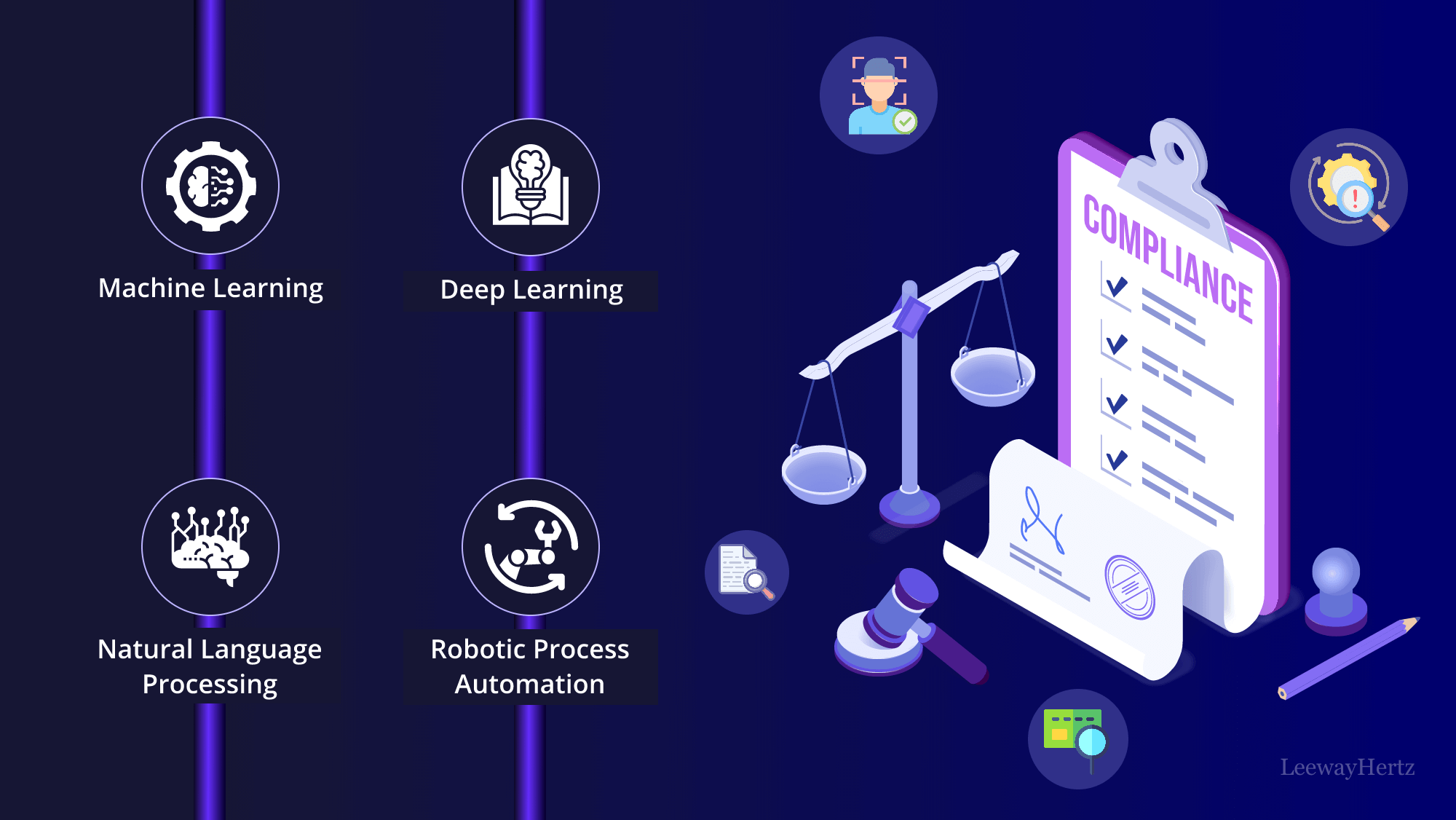

Real-Time Risk Detection: Leveraging AI-powered audit platforms enables DAOs to identify suspicious activities or risks as they occur, helping prevent fraud and unauthorized fund movements.

-

Regulatory Compliance: Transparent financial reporting and immutable audit logs help DAOs meet evolving regulatory standards, making it easier to demonstrate compliance during external reviews.

-

Efficient Dispute Resolution: Clear, on-chain audit trails provide an indisputable record of all actions, simplifying the process of resolving disputes or investigating anomalies.

-

Optimized Treasury Management: Transparent audits enable better financial oversight, supporting informed decision-making, asset diversification, and strategic collaborations for treasury growth.

Implementing Regular Financial Audits

Routine internal and external audits are essential for verifying the accuracy and completeness of DAO financial statements. Internal audits provide ongoing oversight by trusted community members or specialized committees. External audits, often conducted by third-party firms, deliver unbiased assessments of compliance, policy adherence, and risk management effectiveness. According to Hashwork, regular audits help DAOs identify discrepancies early and reinforce procedural discipline.

For maximum impact:

- Schedule quarterly or biannual external audits

- Publish audit reports directly to the community forum or website

- Create an open feedback loop for members to question findings or request clarifications

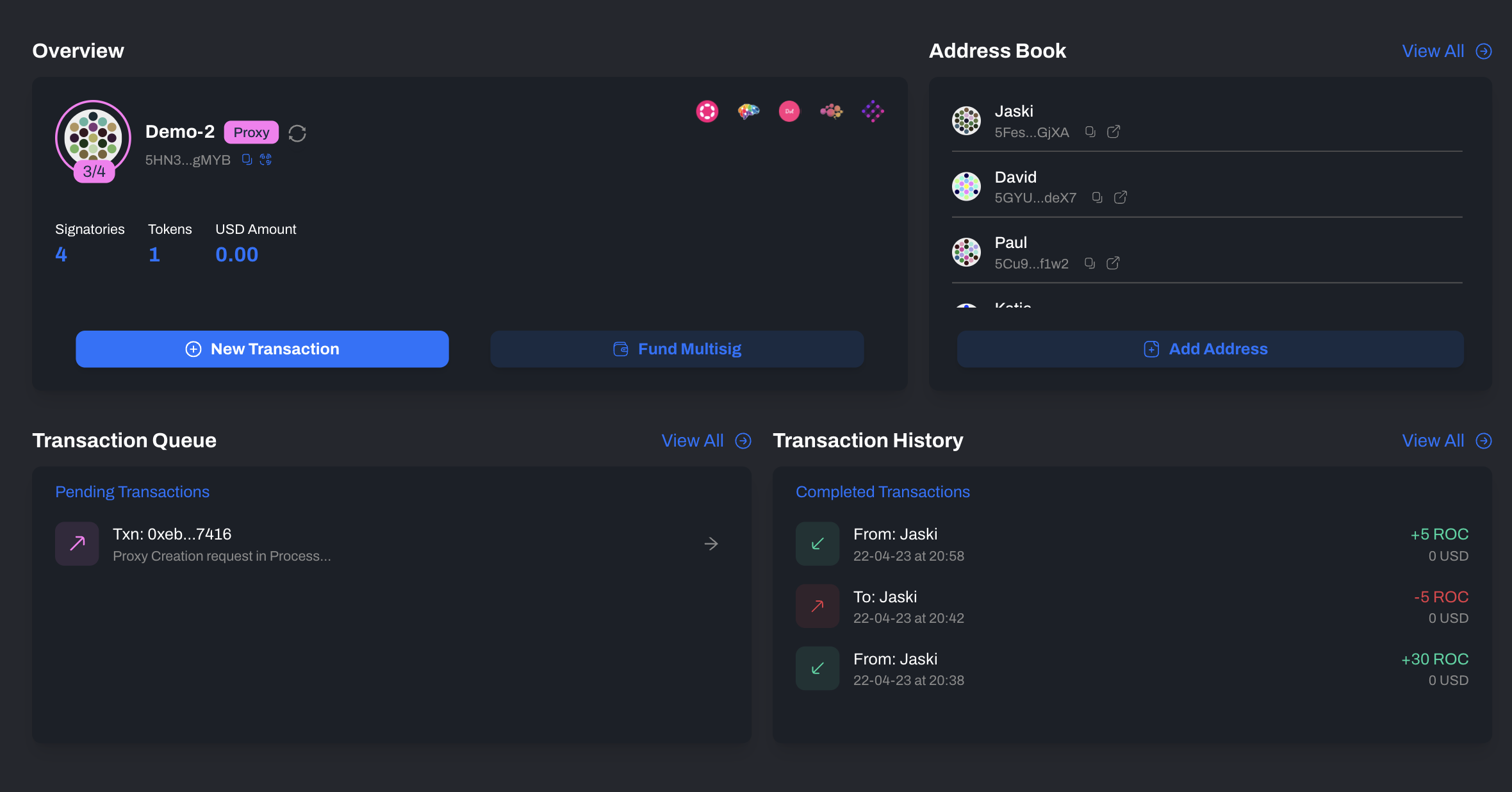

The Role of Multisignature Wallets in On-Chain Security

A single point of failure is antithetical to decentralized governance. That’s why most DAOs secure their treasuries with multisignature (multisig) wallets. These wallets require multiple authorized parties to approve any transaction before funds move, eliminating unilateral access risks.

This approach not only strengthens security but also provides a transparent record of who approved each transaction. For a deeper dive into multisig implementation and its impact on security, see the insights from DisruptDigi.

Transparent Reporting Practices: Building Trust Through Disclosure

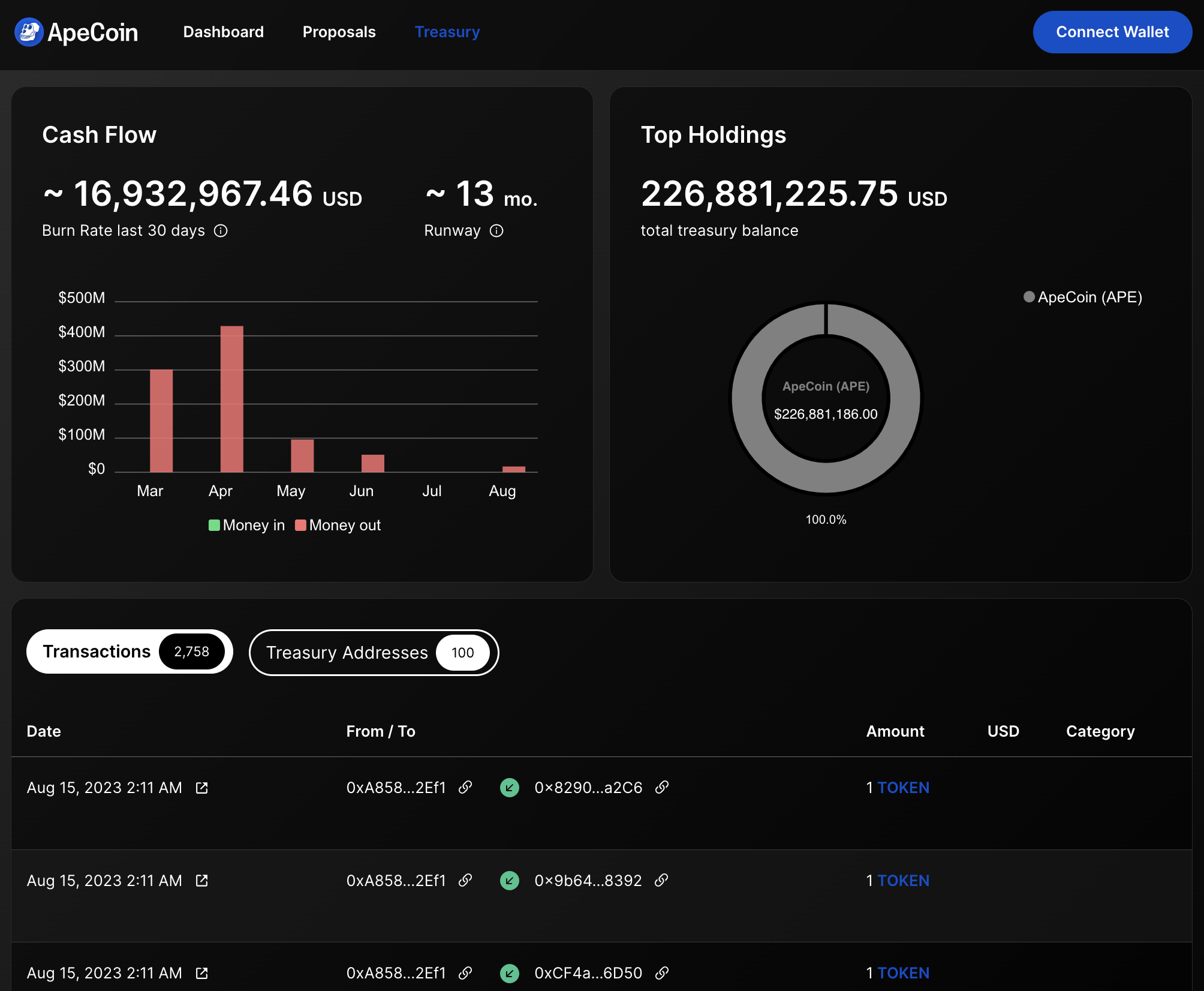

On-chain treasury transparency demands more than just open ledgers, it requires accessible financial reporting that all stakeholders can understand. Leading DAOs publish monthly or even weekly financial statements detailing balances, income sources, expenditures, asset allocations, and outstanding liabilities.

This reporting should be:

- Tamper-proof: Published directly on-chain or via platforms that timestamp records immutably

- User-friendly: Accompanied by dashboards or visual summaries for non-technical members

- Inclusive: Covering stablecoin vaults, tokenized assets, DeFi positions, and pending proposals impacting finances

An excellent resource outlining these practices can be found at Tokenomics.net’s DAO Treasury Management Ultimate Guide.

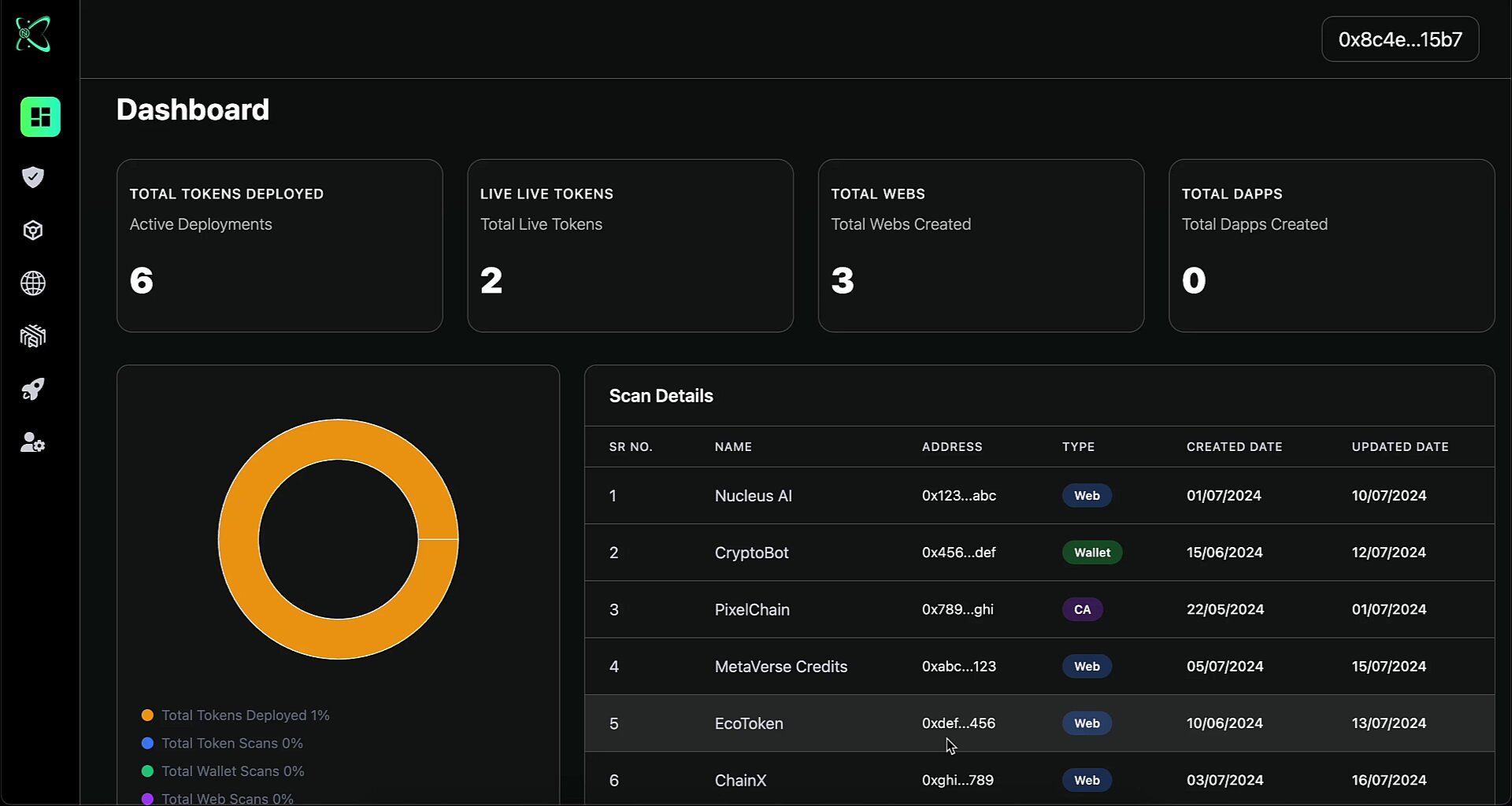

Another major leap in DAO treasury auditing is the integration of AI-powered risk detection. As DAOs scale and governance actions multiply, it becomes impractical for human auditors alone to monitor every proposal or transaction for potential threats. AI models trained on historic DAO governance data can flag anomalies, score proposals based on treasury impact, and alert the community to suspicious activity in real time. This proactive approach to risk management helps maintain balanced decision-making and protects against both internal collusion and external exploits.

For example, platforms highlighted by IdeaUsher are already leveraging these models to automate parts of the audit process, making continuous oversight feasible even for large, complex treasuries.

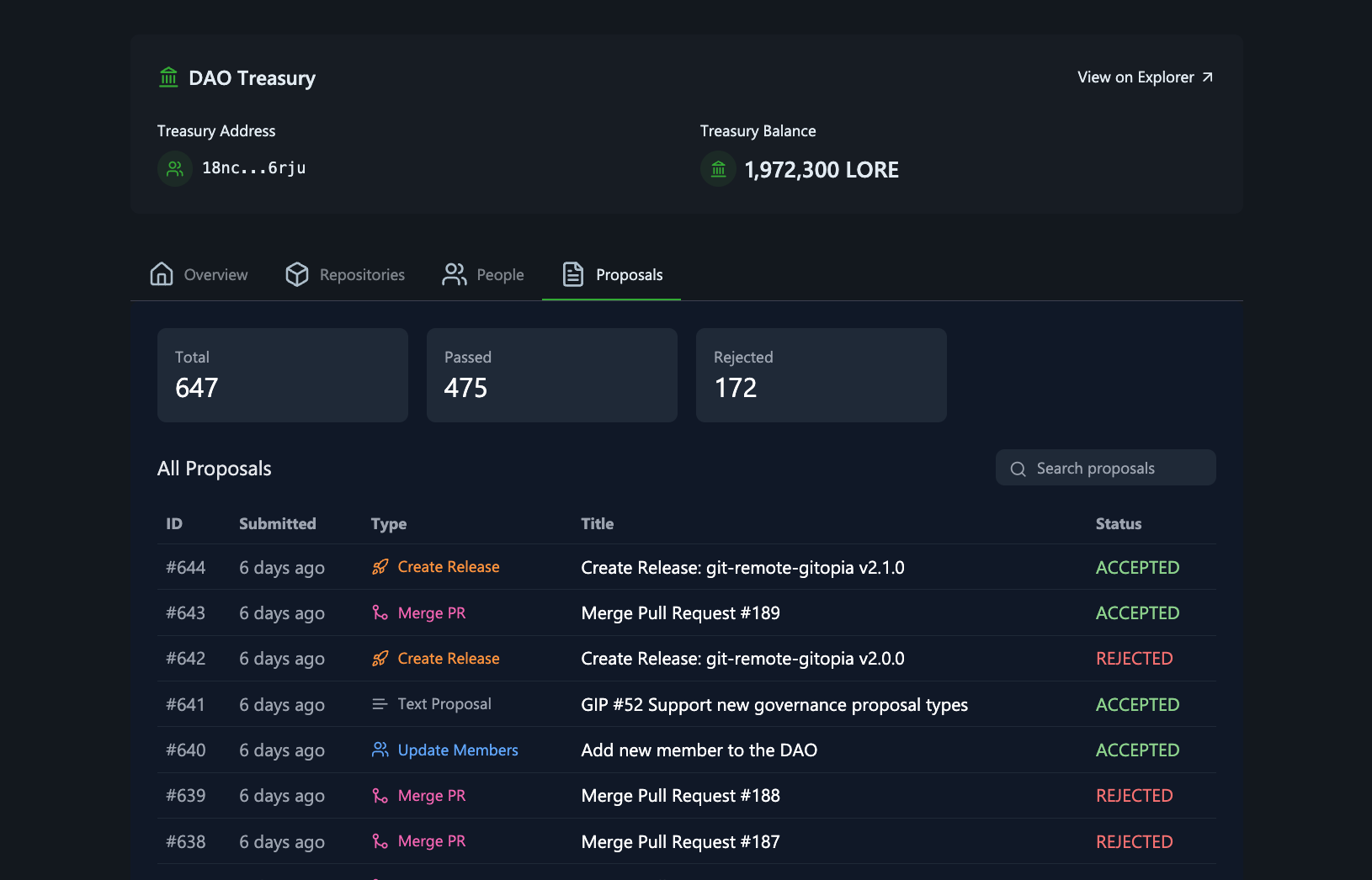

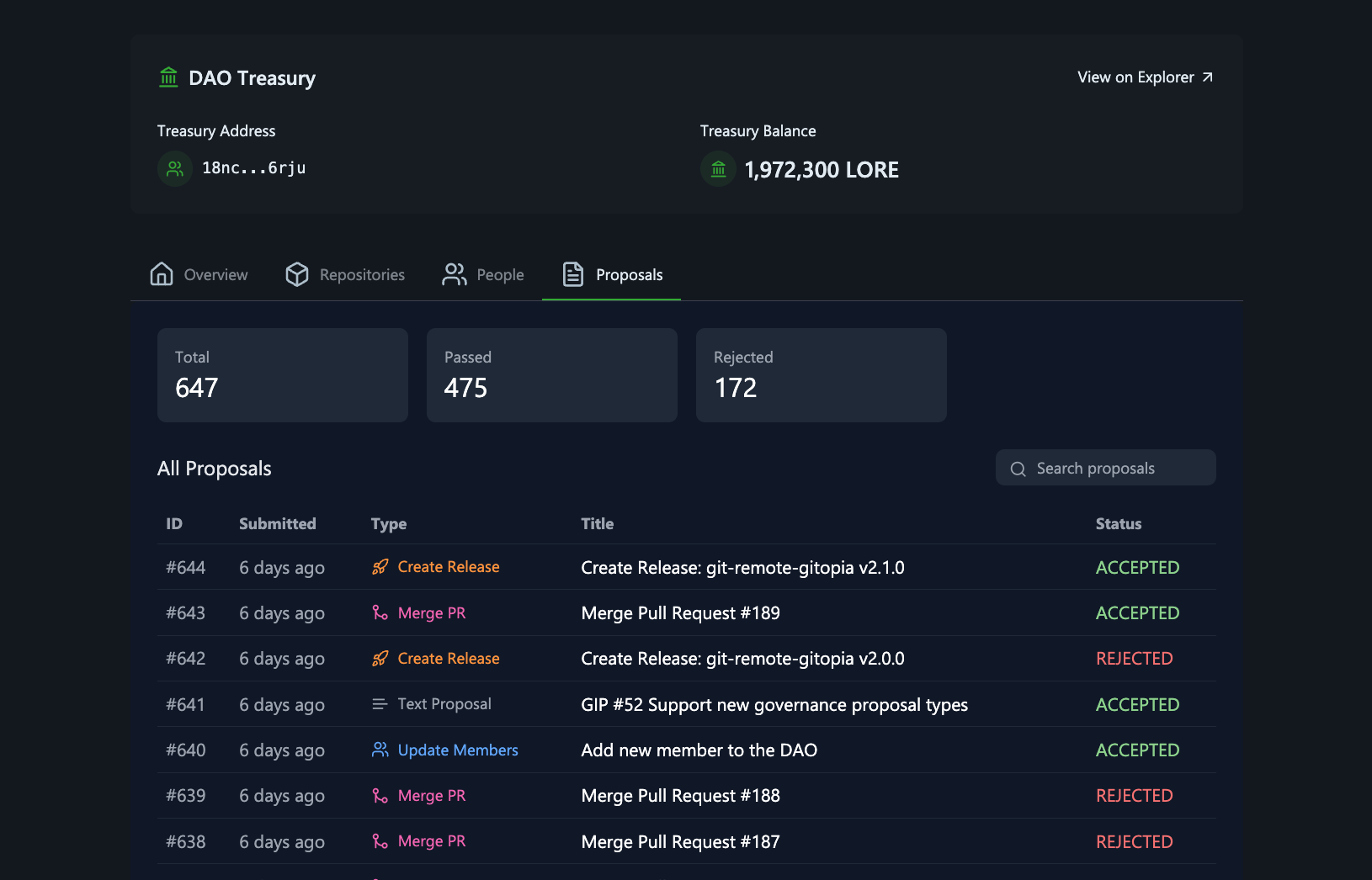

Immutable Audit Logs and Visualization

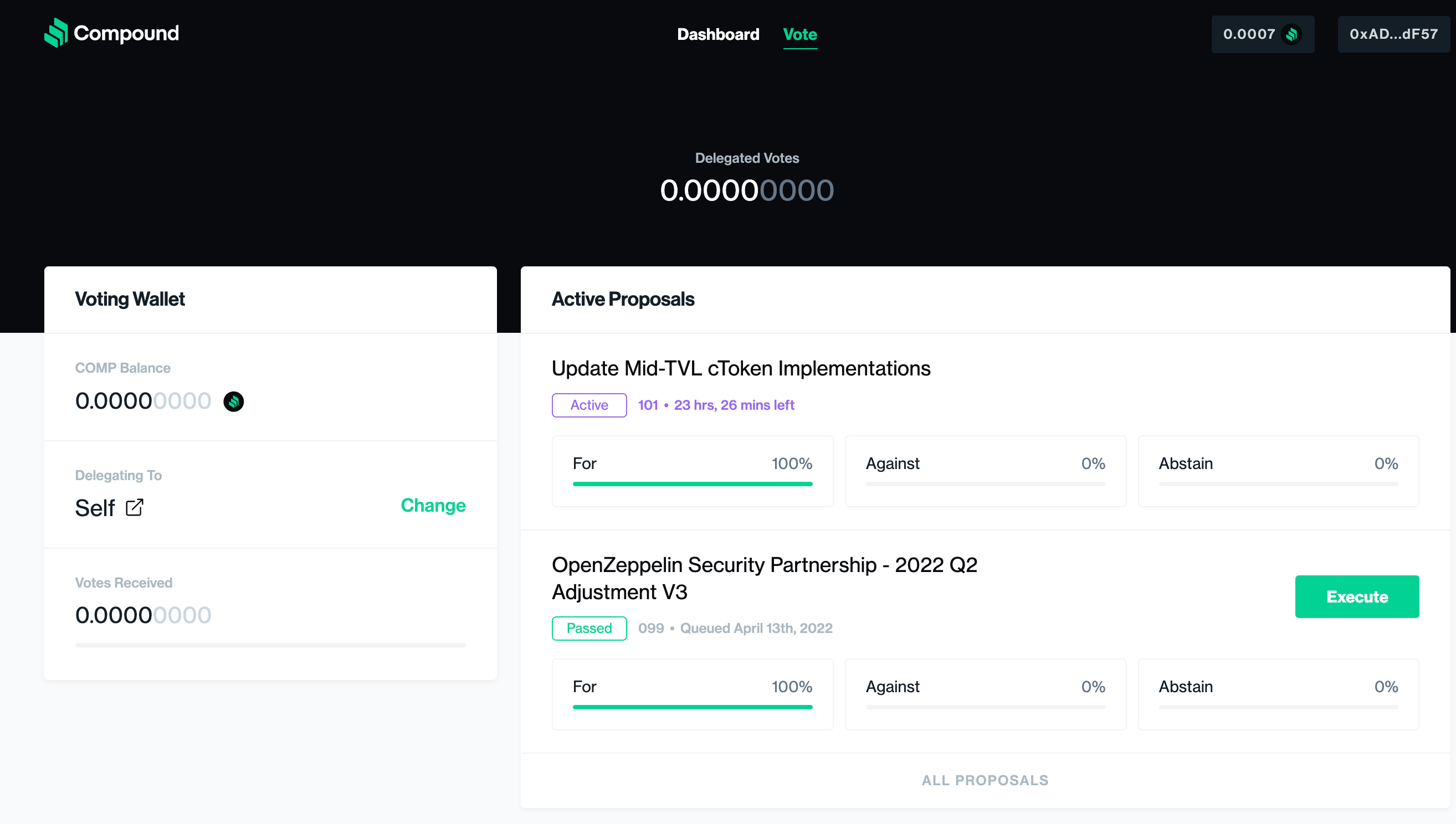

At the heart of any robust DAO transaction audit is an immutable on-chain audit trail. Every governance action, votes, proposals, fund allocations, should be captured on-chain in a way that cannot be altered or erased. But raw blockchain data can be overwhelming. The best DAOs use time-sequenced dashboards that visualize these logs, making it easy for both members and regulators to verify decisions, track fund movements, and resolve disputes efficiently.

This level of transparency not only supports compliance but also simplifies dispute resolution when questions arise over past decisions. For practical implementation advice, refer to IdeaUsher’s guide on building DAO audit platforms linked above.

Top Features of Effective DAO Audit Dashboards

-

On-Chain Immutable Audit Logs: Dashboards must provide time-sequenced, tamper-proof audit trails of all transactions, votes, and proposals, leveraging blockchain transparency to ensure every action is verifiable by the community.

-

Real-Time Multisig Wallet Monitoring: Effective dashboards integrate with multisignature (multisig) wallets such as Gnosis Safe, displaying pending and completed transactions that require multiple approvals for enhanced security.

-

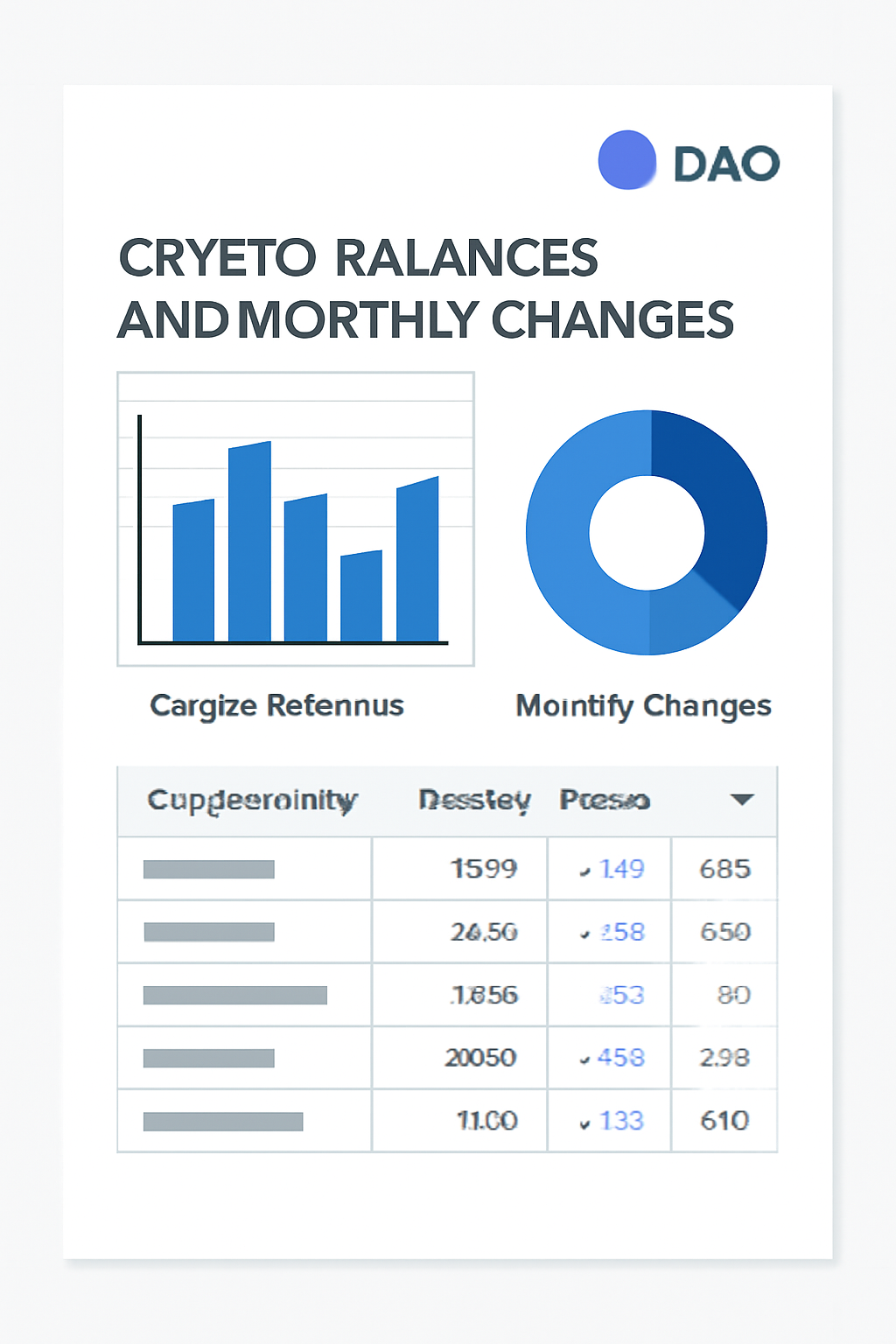

Transparent Financial Reporting: Dashboards should publish monthly financial statements detailing treasury balances, income, expenditures, and asset allocations, enabling stakeholders to assess the DAO’s financial health at a glance.

-

AI-Powered Risk Detection Tools: Incorporate AI-driven analytics that score proposals and flag suspicious activity based on real-time governance and transaction data, helping DAOs proactively manage risk.

-

Centralized Financial Flow Tracking: Utilize platforms like Request Finance to aggregate all treasury transactions in one place, simplifying audits and ensuring every movement of funds is accounted for.

-

Asset Diversification Visualization: Dashboards should clearly display diversification across stablecoins, major cryptocurrencies, and tokenized assets, helping members understand risk exposure and liquidity.

-

Collaboration and Integration Features: Enable seamless integration with other DAOs and DeFi protocols to facilitate pooled resources, joint audits, and strategic partnerships for enhanced financial stability.

-

Member Rights and Access Controls: Clearly define and display member permissions, voting rights, and responsibilities within the dashboard, ensuring governance transparency and accountability.

Asset Diversification and Strategic Collaboration

No discussion of on-chain treasury transparency is complete without addressing asset management. Concentrating all assets in a single token exposes the treasury to unnecessary volatility risks. Savvy DAOs diversify their holdings across stablecoins (for liquidity), major cryptocurrencies like Bitcoin and Ethereum (for growth), and even tokenized real-world assets. This approach not only safeguards value but also provides a more resilient financial foundation for the organization’s mission.

Strategic collaboration with other DAOs or DeFi protocols can further enhance financial stability. By pooling resources or co-investing in vetted opportunities, DAOs may unlock greater returns while distributing risk more effectively, a practice increasingly discussed among leading DAO operators.

Centralizing Financial Flows Without Sacrificing Decentralization

The paradox of decentralized finance is that too many fragmented tools can actually obscure transparency. Modern DAO treasury management platforms now offer centralized dashboards where every transaction, from payroll disbursements to DeFi yield farming, is tracked in one place while remaining fully auditable by any member. This centralization streamlines operations without undermining the core principle of collective oversight.

Request Finance details how centralizing financial flows aligns with both operational efficiency and community trust by ensuring all inflows and outflows are accounted for transparently.

Best Practices Checklist for Auditing DAO Treasuries

The path toward truly transparent decentralized finance compliance isn’t just about technology, it’s about culture. When DAOs embrace regular audits, multisig security, open reporting, AI-driven risk detection, immutable records, diversified assets, strategic partnerships, and streamlined workflows, they set new standards for accountability in Web3 governance. These practices don’t just protect capital, they inspire confidence among contributors old and new.